VRA Weekly Update: Trump is Going to be Impeached. Here is What That Means to Us.

/Good Friday morning all. An important (early) heads up.

While we remain very bullish, medium to LT, there’s a scenario that we believe is becoming increasingly likely….we’ll be surprised if the markets like it much.

The House is going to impeach Trump. There’s almost no scenario at this point where they do not.

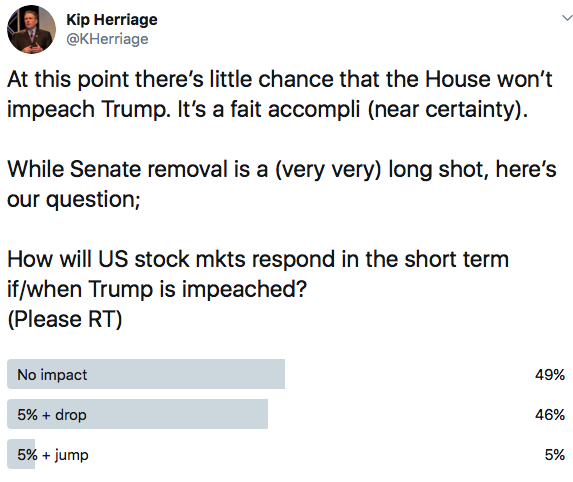

Twitter polls and the feedback from them is always interesting. With just a few minutes to go, the results from the poll on impeachments impact on the markets tells us that it’s almost a 50/50 split, with 49% saying that an impeachment would have no impact and 46% saying that a 5%+ decline would follow (impeachment in the House only, with no removal from the Senate trial that would follow).

While Trump will not be removed from office in the Senate, just imagine what our MSM will look like, following House impeachment. 24/7 “how can we re-elect a man that has been impeached????”

And yes, this includes Fox, which outside of a few LT supporters, is also flipping to TDS Trump-hatred. As always, the sheeple that still pay attention to MSM will be impacted. Wall Street elites, portfolio managers and Trump hating sheeple in their own right, could once again become sellers of equities. Globally, negative equity flows would likely follow. The world is watching the lunacy taking place and must be saying, “what in God’s name is happening in the US? You’re going to impeach a US president over his views/decisions on foreign policy with Ukraine????”

Of course, we know the truth. The game plan of the left has been to remove Trump from the very beginning. The 2+ year long Mueller Special Counsel investigation didn’t work, so instead of “Russia, Russia, Russia, its moved on to “Ukraine, Ukraine Ukraine”. The motivation is of course influenced by deep state establishment intelligence community operatives that see AG Barr and the nearing FISA report as potentially fatal to their cause…maybe worse, with criminal charges increasingly likely.

This impeachment could happen rather quickly folks. Our fake news polls would quickly begin to show that “the odds of Trump being re-elected now look dire”…or something very similar to that effect.

Our view remains that as long as the economy remains strong, Trump will win. We have little doubt about this. But that’s not how the MSM will portray it. Again, nothing about this would be a positive for equities, but it will help to build our wall of worry, which would then lead to our next great buying opportunity.

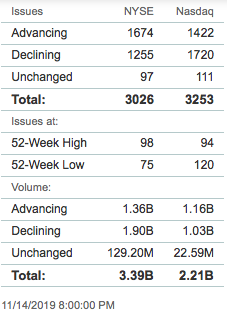

And there’s this; With sentiment having quickly flipped back to bullish, and markets at extreme Overbought and internals looking a bit ugly, a rather sharp move lower could lie just ahead. “Could”.

This is NOT a prediction. Simply that Tyler and I have mapped out the possibilities and we do not want to be caught on the wrong side of what could be a quick/painful 5%+ move lower.

The feedback to our poll that Trump “will” be impeached was also enlightening. The most common reply we received went like this: “investors know that Trump is not going to be removed from office over this Ukraine deal. The markets are using this as part of their wall of worry move higher”.

We have some bright VRA Members.

Bottom line: You know my short-term concerns; we are at extreme overbought levels on momentum oscillators. Across the board. This is when bad things tend to happen. Sentiment has shifted to overtly bullish. Our wall of worry concerns have dissipated (somewhat). As contrarians, we’re always more comfortable buying when investors are fearful. But, we’re also nowhere near “euphoria”, meaning we may just have to get used to being comfortable with investors that are becoming more and more bullish. This is in fact how market melt-ups take place. And yes, this is how we get to our year-end target of DJ 30,000, which sits just 7.5% higher as we start the day.

And there’s this…we’ve now had 8 straight days of mixed/negative internals while extreme overbought at the same time. Nothing seems to be able to slow this move higher. As my mentors taught me, overbought markets that keep going higher are among the most bullish signs of all. #GarlicStrong

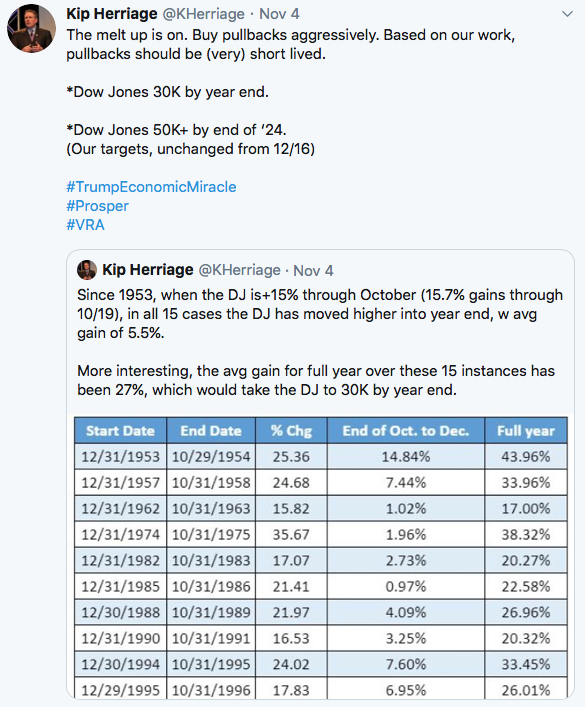

And for our fans of analytics, we’re reposting this from 11/4/19. Since 1953 (15 cases) when the Dow is +15% through October (as it was), the average move higher for the full year has been 27%. Should this occur again in ’19, the Dow will close at almost exactly 30,000.

Until next time, thanks again for reading…have a good weekend

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast