Earnings, Share Buybacks and M&A Will Continue to Power Forward. Investor Sentiment, Bulls Returning. Global Bull Market, Fully Intact.

/Good Thursday morning all.

A solid reversal higher yesterday, even in light of our extreme overbought conditions. VRA Market Internals moved back into solid territory, though not as solid as the negative readings that we saw on Tuesday.

Still, 10/12 VRA Investing System screens remain bullish. This still looks to be a pause…

We did have 1–2% weakness overnight in Chinese markets, but again, their markets had reached a nearly identical level of overbought as ours. This morning, futures are slightly higher. Tomorrow, we kick off Q1 bank earnings…then the pace picks up next week…followed by the full onslaught of earnings releases the following week. With earnings reports, many/most of the reporting co’s can also resume their share buybacks.

Remember, in 2019, the estimates are for more than $1 trillion in share buybacks along with $5 trillion in M&A activity. Combined, we’re talking about a (continued) massive level of share reduction from US markets. This is ECO 101 folks…”as supply decreases, assuming demand stays the same or rises, prices must also increase as well”.

Our permabear friends seem to struggle mightily with the basic law of supply and demand. But its a powerful, powerful force…one that continues to serve as underlying foundational strength for this bull market to soar, for years to come.

As we’ve discussed the last few days, our markets have reached extreme overbought. This is merely a short term warning sign…has no impact at all on our views otherwise…merely a timing issue.

Here’s the deal; we have restricted share buybacks due to the blackout period just prior to earnings releases. But once these co’s report their Q1 earnings, those buybacks will resume. Banks begin reporting on Friday, but the majority of our major S&P 500 components don’t start report for another 7–10 days. We have a lull…a pause…but I fully expect that will be about all that it is. At most.

INVESTOR SENTIMENT UPDATE

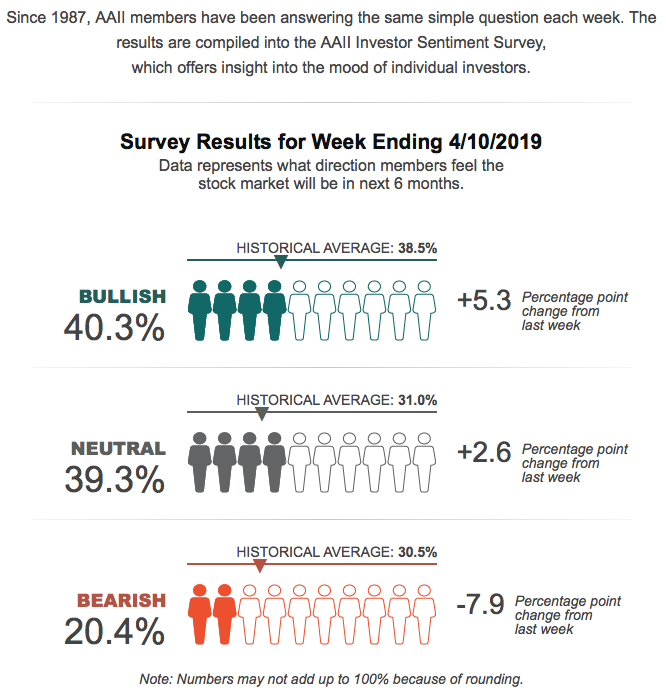

Here are our investor sentiment reports, both updated as of last night. First, we see that in the AAII survey, bulls have increased to 40%, with bears down to 20%. As we’ve been discussing, this is the beginning of euphoria returning to the markets. This is 1997/1998…just as the dotcom boom was finding its footing. Before this bull market tops, bulls will hit 65–75% readings, for months on end. Thats been my forecast for the last 2+ years…its been spot on accurate…take it to the bank. But to be clear…no, the move higher will not be straight up…it never is…trees don’t grow to the skies, overnight.

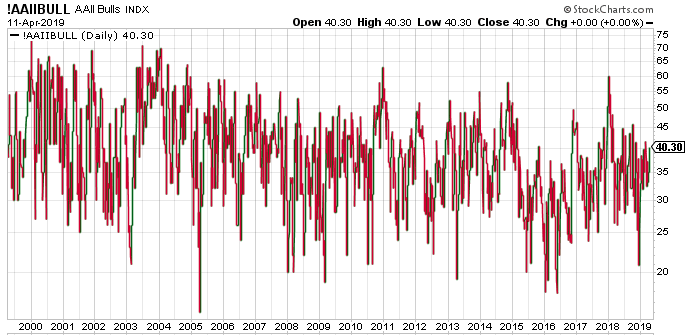

Take a look at the long term chart of the bullish percent from the AAII Investment Sentiment Survey, my go-to sentiment survey for 30 years. Today, bullish percent sits at just 40%. How remarkable, with the move higher we’ve had, that bulls are at just 40%.

As you can see, major bull markets (like this one) do not top until bulls hit 65–75%, and remain there for an extended period, We will not have a final market top until euphoria returns. I see that as being years away. DJ 35,000 by end of 2020. DJ 50,000+ by end of 2024.

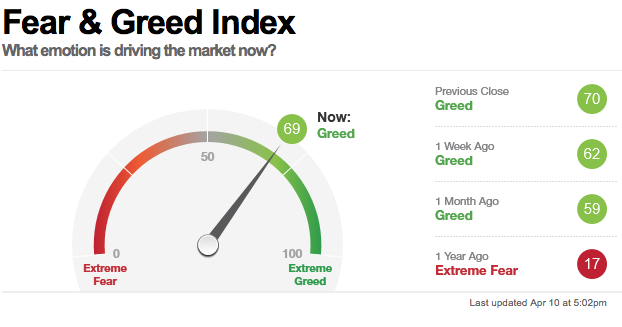

And here's the updated Fear and Greed Index, which now sits at 69. Greed has returned….but we’ve also seen this reading hit 90% + many, many times over the recent years. And who can forget the 12/24 Christmas Eve massacre reading of TWO! All-time low….thats how we knew that big time lows were in place. Our view remains the same; just as the March 2009 lows were THE lows, which we’ll likely never see again, we believe that the 12/24/18 lows will prove the same.

Finally, please join us daily for our VRA Investing System Podcasts! Sign up to receive instant updates once our recording is completed at www.vrainsider.com/podcast.

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Learn more at VRAInsider.com