Jobs Growth Blowout, Global Bull Market Will Continue to Impress

/Good Friday Morning all,

Tyler Herriage here with you for today’s update.

After a slow last 2–3 sessions, the markets are positive as we received the closely watched Labor Department’s monthly employment report this morning, which came in with a blowout number.

April non-farm payrolls crushed estimates of 190,000 new jobs by over 70,000, coming in at 263,000 new jobs created in April. Even more good news came from revisions of February’s weak number which was raised from 33K to 56K. Unemployment also continued to drop from 3.8% to 3.6% and remains at a 50 year low compared to 3.5% in 1969. That is right the best jobs market in 50 years. While we have to sift through all of the numbers still, it looks that the minority unemployment rate just dropped to all time record lows, a point President Trump will certainly be making shortly, as he should as this is hugely bullish for our overall economy and prosperity as a nation.

If you’re still concerned about a recession…or maybe slower corporate earnings…we recommend that you listen to experts that know what they’re talking about. They’re the ones that get it right, much more often than they get it wrong. If you’re not sure who the real pros are (outside of the VRA, of course) a good place to start is with my Twitter feed (@kherriage). Each day I retweet some of my most trusted sources. Begin following some of them…you’ll find that you no longer need those wrong-way gurus.

$2 Trillion Infrastructure Deal?

We also learned Wednesday that, and this was a shocker to yours truly, that Trump and leading Dems look to have reached a basic agreement on a $2 trillion infrastructure deal. Thought I was reading The Onion at first. They claim to need 3 weeks to put together the funding side, which means that anything can happen between now and then, let’s hope that our Washington leadership can prove that they actually care about the people of this country.

A bipartisan deal on infrastructure would be hugely bullish for the economy and equity markets. Structured correctly, with public-private partnerships, targeted directly at our most pressing infrastructure needs (roads, bridges)…instead of Obama era fundings like now bankrupt and out of business solar fraud Solyndra.

Earnings Numbers

We continue to see the best quarter of earnings in nearly 10 years. 67% of the S&P 500 (333 co’s) have reported 1Q19. 77% beat EPS ests on +7.2% growth. 61% beat sales estimates on +4.4% growth.Don’t listen to the market bears who have told you there was a coming recession. When they were wrong they said there would be an “earnings recession”. Well it appears that they were wrong again and I’m sure they will have a new story to tell us here soon.

Not only is the economy not slowing, its continuing to pick up speed. We’ll repeat our long held beliefs, once more. Trumps tax reform and deregulation efforts will drive the US economy past 4% GDP growth…possibly even past 5%…before he leaves office. 50,000 + DJ.

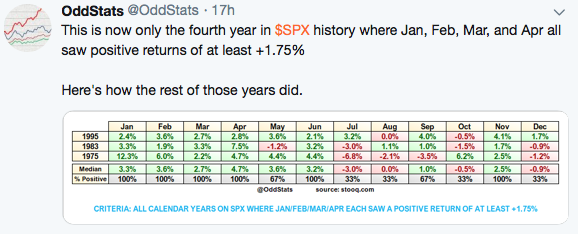

This is just the 4th year in S&P 500 history that the first 4 months of the year each had positive returns of at least 1.75%. Bodes very well, for at least May and June.

WSJ Loves Small Caps…Welcome to the Club.

This Tuesday’s Wall Street Journal reads like a VRA Update from the last couple of weeks. Small caps are ready to run. Their primary thesis? A rising tide lifts all boats. With S&P 500 and Nasdaq at all time highs, and with the Dow Jones knocking on the door, its time for a serious catch up move higher.

WSJ also makes the very good point that the strong US dollar has little of the same impact on small caps that it does on large cap, US multinationals, where a strong dollar acts as a headwind to earnings.

With the Russell 2000 still 8% below its all time highs, as we’ve been writing, this is the index we want to pay serious attention to.

We featured the chart of small cap ETF (IWM, Russell 2000) last week in our blog, along with our forecast that a breakout was nearing. We have that breakout, as can be seen on the trend line below. In addition, IWM just experienced a Golden Cross (50 dma crossing over 200 dma), another bullish technical event.

This chart checks all the boxes for the VRA Investing System. We are aggressively long small caps…the move higher is still in the very early innings.

Importantly, each US broad market index (S&P 500, Dow Jones, Nasdaq) today sit at overbought levels. The Russell 2000 does not. Another reason to like small caps here.

Global Conditions

Finally, for the day, U.S. China trade talks continue in full as the two parties look to get a deal done in the near future. Next Wednesday Chinese Vice Premier Liu He is scheduled to arrive in Washington with the hope of wrapping up a deal. This resolution will be a big win for both countries and we want to be positioned ahead of a deal being announced.

This trade war has been brought about for many necessary reasons, but probably one of the most crucial elements is cracking down on China’s IP theft from U.S. Businesses. China is already known to spy heavily on its own citizens. Check out the article published yesterday by Bloomberg exposing Chinese surveillance methods based on research by the Human Rights Watch.

If they have this level of research on their own people, which includes foreign citizens who travel to Xinjiang, think about the broader implications of what this would mean if we had more unregulated Chinese communications and technology services in the United States. No privacy would be safe, much less protecting our business IP. Although we would be naive to think the U.S. isn’t already doing the same to many of us here in the U.S.

Asian markets have seen a pullback after their tremendous start to the year, but looking at the charts it is more of a lull than a correction. Now, their indexes are at oversold conditions on VRA screens.

Check out the chart of ASHR, meeting all of our technical parameters, above the 200 day MA, extreme oversold on Stochastics, strong volume of buying since February. No better time than now to be positioned before the train leaves the station.

Until next time, thanks for reading…

Tyler Herriage

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Learn more at VRAInsider.com