Economic Data Points to Acceleration of Growth. We Repeat, No Recession. Capitulation Signals. Interview with WAR.

/Good Thursday morning all. We’re in the dog days of summer. Low volume sell-offs, like yesterday, during one of the worst months of the year (August). Not even close to a big enough reason to sell. We’re also seeing classic signs of a reversal higher as the TRIN (short term trading index) closed at 3.65. Anything above 1.5 is excessive bearishness. We saw excessive bearishness in the put/call ratio as well, meaning that more investors were buying puts than calls. Both are used as contrarian indicators. We’ll repeat, based on our work, it’s likely that the lows for the year are in place.

Thanks again to our great friend Wayne Allyn Root (WAR!) for having me on his TV/radio show again last night. While sheeple are losing their heads over an 800 point down day and amid (propaganda) calls for “recession, recession recession”, WAR’s instincts are spot on as always. We’re in complete agreement; events in China have pretty much no chance of causing a recession here in the US. Here’s the link for those that weren’t able to join us; https://soundcloud.com/user-640389393/kip-herriage-live-on-the-wayne-allyn-root-show-raw-and-unfiltered

The prior guest last night was Fox news legend Bill O’Reilly. If I listened to his economic reporting on the economy and housing, I would probably be bearish as well. O’Reilly stated that “the housing industry is in a serious slide, with mortgage delinquencies on the rise, a big warning sign to the US economy….”

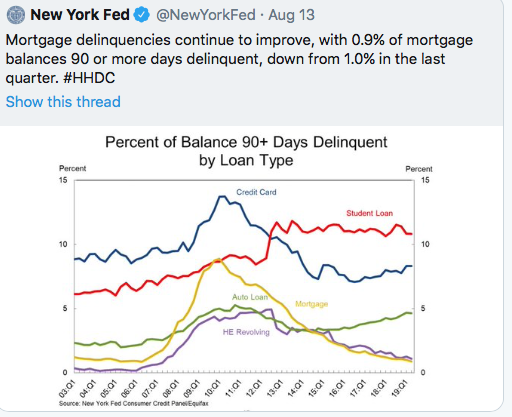

There’s just one problem…O’Reilly got his facts 100% backwards. Mortgage delinquencies are at 16 year lows. The US housing market is rock solid and getting stronger (as we’ve covered here often and why we now NAIL, 3 x Housing ETF):

Busy start to the day. Economic data just coming in (retail sales and Philly, empire Fed), all with “solid” beats to expectations. I’ll repeat…there is no recession on the horizon. Not even close. In the interest of time, allow me to paint a picture for you via my Twitter account:

If I am wrong…if an inverted yield curve is going to push the US into recession…remember these analytics;

Should a recession occur, based on inverted yield curves from 1950, a recession would not take place for 19 months and a stock market top would not occur for 12 months. In addition, the average gain for the S&P 500 (over the next 12 months) is 15%. In other words, an inverted yield curve is BULLISH..for at least the next 12 months.

Yesterdays trading also gave us a number of capitulation signals. Again, the TRIN closed at 3.65…the highest reading in 4 years. And 94% of volume was selling..another classic sign of selling pressure exhaustion. It’s mid-August folks…vacation time…light volumes, with few around to buy. We’re in bull market confirmed status. Don’t fight the tape, don’t fight the Fed.

10/12 VRA Investing System screens remain bullish. We’re still in “back up the truck and buy” territory. Make sure and login to your VRA Members Site to ensure you are positioned correctly. We are big believers in monthly dollar cost averaging. By year end, we believe you’ll be glad you did.

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast