VRA Weekly Blog Update: As Expected, September Fireworks. Key Housing Barometers at New Highs. Stunning Sentiment Readings Continue.

/Good Thursday morning all. Overnight we learned that US-China trade talks are back on, with mid-level talks beginning this week and the big kahoonas confabbing next month. DJ +443 as I write.

Global markets are also in rally mode on the heels of Hong Kong withdrawing plans to enforce their extradition bill, in conjunction with Mainland China earlier this week.

We stand by our 8/29 VRA Blog Update. We even dance to it. The ramp higher is on. Fireworks to the upside.

One More time…September is Here. E,W & F style

https://www.youtube.com/watch?v=Gs069dndIYk

September, Hugely Important. I Expect Fireworks to the Upside

Here at the VRA we’re big believers in viewing the stock market as a “leading indicator” and as “the single best discounting mechanism on the planet”. This was the mindset and training of my mentors (RIP Ted Parsons and Michael Metz), who themselves learned this investing approach from their mentors, both of whom worked on Wall Street during the Great Depression. Quite the lineage, no? Not a day goes by that I don’t hear their voices and give thanks.

As a discounting mechanism, it’s my belief that the markets will (soon) begin to move sharply higher, giving us advance notice of the events that we can expect in September (do you hear the song in your head…cause I do). Here’s what September is about to deliver:

1) The ECB has already pre-announced their “Big Bazooka”, in what will be aggressive central bank policy of interest rate cuts AND the re-start of QE, or quantitative easing. The ECB meets on 9/10. Expect fireworks…with strong language from the ECB that more is to come

2) The following week (9/17) our Fed meets. While we won’t follow the ECB with a re-start of QE, we WILL have a rate cut of 1/4 to 1/2 percent, with almost certainly a change in the Fed’s language, strongly hinting that additional rate cuts are on the way.

3) and in what could truly be a jolt to the upside for markets, China is still on for a D.C meeting next month. There is little to no excitement today about a trade deal being reached (should they make the trip), which is music to my ears. Folks, we want the surprise out of nowhere….one that sends the DJ 3000 points higher over the next month. Again, the markets will almost certainly begin to discount the possibility of “some” forward movement in US-China trade.

All of the above takes place within the next 2–4 weeks. I fully expect a ramp higher in the markets in advance. It may already be underway.

Now is not the time to be bearish. Central banks are about to re-announce to the world “get your money out of banks and savings accounts. Put your money into stocks and real estate. Do it now, because if you don’t, we will keep cutting rates until you do. Do not fight us. We are the all knowing, all seeing, all powerful, masters of the universe.”

One day, central bank madness will become a massive liability. This is not that day.”

-------

The VRA Portfolio continues to outperform the markets in 2019(VRA +21.9% vs S&P 500 +17.33%). Investors remain overwhelmingly bearish, as we see each week in our investor sentiment surveys and continued outflows from equities.

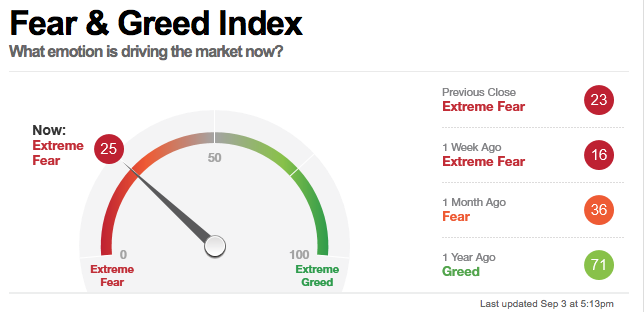

Here’s the latest Fear and Greed Index Survey, updated last night.

A reading of 25…Extreme Fear…with US markets just 5% from all time highs. In my 34 years I have never seen anything like this. I’ve said it before, I’ll say it again, these ultra bearish surveys are stunning.

Know this; the investing public is rarely (if ever) right about the direction of the stock market. When investors are ultra bullish, we should be ultra cautious. When investors are ultra bearish, as today, we MUST be ultra bullish. This is how we are positioned…we remain in “back up the truck” territory.

The VRA Investing System remains at 10/12 Screens bullish. Comprised of fundamentals, technicals, internals and sentiment, the VRA System is designed to have us in the markets in advance of bull market, big moves higher and out of the markets, in advance of bear market, big moves lower.

It is important that the small caps and transports begin to act better, but with our Leading Economic Indicators flashing “economic expansion” and our housing indexes (ITB, XHB) near 52 week highs, all signs point to further economic growth.

I became a broker in 1985. Reagans tax reforms and deregulation were just beginning to fully kick in. US markets would double over the next 2.5 years, taking the global economy higher with it. Reagan went on to help create more than 20 million new jobs. The Trump Economic Miracle will be more impactful. Yes, taking down China and elitist globalists is a major battle….scars will be left…but folks, the end result will be an economic boom the likes that we haven’t seen in a generation. The Trump Economic Miracle will not only take us back to 4–5% GDP but it will power the worlds economic engines along with it.

Each point made above has been my view since Trump was elected. I may be wrong…but I tend to get the big calls right.

— — — -

Of course, after the “Russia Russia Russia” hoax and “Impeach Impeach Impeach” fraud both fell by the wayside, TDS infected never-Trumpers had to find something else to fear monger Americans about. What did they choose? “We’re going into a recession! Run…run away from the US economy as fast as you can!”

But once again, lies based in fiction rarely hold up. Folks, as we cover daily, the US economy is on FIRE! Plain and simple, we are in rock and roll territory. We saw evidence of this again yesterday, as 3 key housing sector barometers either hit new all-time highs or are now within 1% of ATH. We know what a slowdown in housing looks like…we warned and alerted extensively about exactly this in 2006–2007, as housing charts/barometers broke down just prior to the GFC. What we’re seeing today is a healthy and improving housing market. The recession hoaxers are going to have to take their crazy elsewhere.

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast