VRA Update: Trump Economic Miracle. Precious Metals and Miners. The Breakout is On.

/Good Thursday morning all. The Philly Fed Index (manufacturing) numbers this morning were pretty remarkable. 36.7 vs est of 8. I don’t put much stock in any single economic report…I actually trust few…but this massive beat does help to put another dent in permabears that love to scream “the US economy is getting weaker.” Recession any day now, don’t ya know :)

The bear's biggest theme continues to be interest rates, as in “rates would not be plummeting if the economy was as strong as you claim Kip.” As I’ve worked to explain to my bear friends for the last couple of years, US rates will continue to decline, regardless of how strong the US economy is (and it's very, very strong).

Why is that? Gravity. Our rates must fall due to international fund flows coming into the US, in order to capture our MUCH higher yields. Simple supply and demand 101.

Precious Metals And Miners

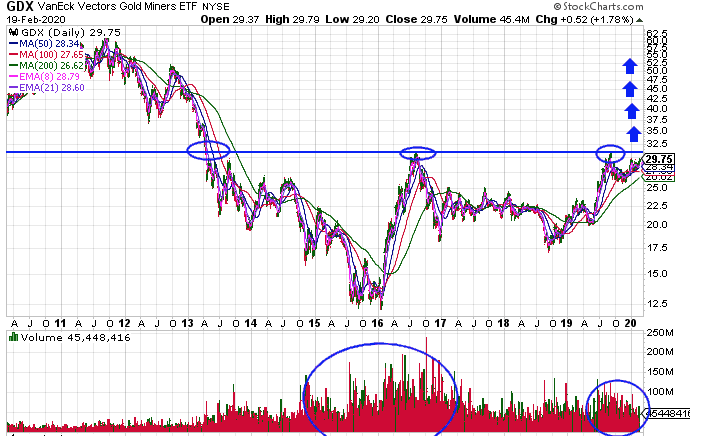

PM’s and miners continue to trade well but, and this is not a biggie, we did not get the volume increase we were hoping for. GDX traded 45m shares vs 65m yesterday. I find that odd but not concerning. Investors have been faked out by this group for so long that its likely skepticism that’s keeping them a bit cautious. But…and this is very good…today we saw an interesting structural development. For the second day in a row gold, silver and the miners (GDX) all closed at the highs of the day. I cannot remember the last time that happened but its a highly bullish development. NUGT was up another 4.8% today, taking its 2-day gains to just under 15% (closed at $35 today).

Once the algo’s jump in…our friendly Skynet bots tend to act together…I expect we’re going to see some rather amazing fireworks.

Also seeing some great charts on gold and GDX from the world of technical analysis. Know that everyone and their momma are watching this group. I mean, the fundamental side of this story could be no better. We cover this often but the world is awash in liquidity, wealth, debt and a shit-ton of currency inflation. You literally could not draw up the fundamental side of this story any better. And, if it's true that the manipulators have been sent a very strong message to back off (JP Morgan RICO case), the move higher that we’re about to see in gold, silver and the miners could surpass even my lofty targets.

What I know for certain is that if gold and silver had not been hypothecated 100 x over for these many years…much of it through the creation of the ETF’s “GLD” and “SLV”…it’s a “lock” that gold would be trading at $3000 to $5000/oz plus today. But it appears that you and I may now be on the same side of the major money center banks. If you remember that piece on JP Morgan I sent out a month or so ago(link below), it claimed that not only was JPM the largest gold/silver short of the past but it had also hedged itself and was the largest holder of gold as well. Let that sink in. They win either way…but now they actually want it to go up.

Bottom line: I believe its increasingly likely that a parabolic move higher is nearing in PM’s and miners. In addition to following gold from the age of 18, when my father bought gold at $800 (he nailed the top, on its way to $380…a 21 year bear market), I started attending precious metals conferences with clients in the late 90’s. Over the VRA’s 15 years we’ve done well in this group. I’d also like to think I have a good feel for this industry. My instincts tell me we’re about to get that parabolic move. It will go on for years. Where will it end up? I think this is that bull market. The one that takes gold to levels that you’d think I was crazy if I put it in writing.

Again, lots of great chart work out there…all saying the same thing; “here we go”.

Heres what I see in my (simple) 10 year chart below. GDX is nearing a triple top at $31 that has been in the works for 7 years. That’s one long base folks. Massive amounts of energy have built up inside of this base. Triple top formations are interesting, as in on the 4th attempt you’re likely to get a blast off breakout. GDX sits just 4% away from $31, after its close of $29.75 today. Should that occur…and I’ll tell you what few will…there is NO resistance after $31. How is that? Because those higher prices occurred more than 7 years ago and those holders no longer matter. They’ve either moved on or sold/bought/sold/bought many times from 7 years back and that resistance is not actually resistance. The ATH was $66.94 (9/2011). We will break though these levels…rather easily….likely in 2–3–4 years.

And remember my favorite contrarian reason to own this group. Today there’s just 1 mining stock in the S&P 500. Newmont. If I only had this as a single fact I would buy this group aggressively. This is the very nature of how sector bottoms occur.

Lastly, we remain at 10/12 VRA Screens bullish. Yesterday’s podcast is a must-listen. Markets that go up on bad news almost certainly want to go higher.

https://soundcloud.com/user-640389393/vra-podcast-kip-herriage-daily-investing-podcast-feb-19-2020

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/17 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast