VRA Weekly Update: Fears of A Tiny Taper. The Bears Are Growling…Music to a Contrarians Ears.

/Good Thursday morning all. 1% losses across the board yesterday but we did see an improvement in the internals (most notably in Nasdaq where up/down volume was flat). The markets are in mini-correction mode based primarily on the 3 factors we’ve been covering here; seasonality, internals and anxiety over the Fed.

Yesterdays Fed minutes showed that the Fed is now talking up the possibility of reducing the $120 billion in monthly QE. But we’ll note that these comments are from the July Fed meeting and prior to our most recent economic reports that showed a significant reversal in consumer confidence and weak retail sales. We continue to view this as an overbought pause/correction and will be putting money back to work before long.

With midterms next year and Team Biden needing all the help they can get, there is a near zero percent chance that the Fed tapers aggressively, if at all next year. The Fed’s financial engineering cannot be put back into the bottle. We’ll have (much) more QE, not less. QE infinity. The 10 year yield sitting at 1.24% this AM, soon headed sub 1% again, should confirm our forecasts. Everything about Bidens presidency screams “Obamas 3rd Term”. Get ready for what will almost certainly be the biggest blowout in midterms, ever. Dems may lose 80 seats in the House.

And we love the fact that the bears are aggressively coming out of the woodwork. Seeing calls left and right now for a 10–20% correction into year end. Sentiment surveys are confirming it as well. Here we sit just 3 days from ATH’s yet the Fear & Greed Index has already fallen back to 25 (Extreme Fear). Music to a contrarians ears.

Futures are lower again this AM. Dow -320. We’re beginning to see our VRASystem screens hit heavily oversold (already) on some of our key indicators.

It’s too soon to act today but remember to look for VRA Alert in your subject line when we are taking action.

With thanks to our friends at The Earnings Scout, these Q2 earnings are just insane. We forecast 80% year over year beats on EPS but they’re coming in at 92.28%. Just…wow.

And folks, if you think Q3 is going to be a letdown, you’re going to be surprised once again. We’re looking for 25–30% growth in Q3 (the street is at 17%).

We had a slight adjustment lower on Monday in the VRA Investing System, as we move from 10/12 Screens bullish to 9/12 screens bullish. We remain highly bullish for the medium-long term but have concerns about the short term potential for a move lower in the broad markets. Short term concerns:

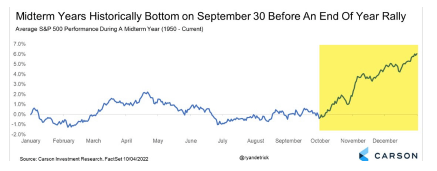

1) Seasonality: While this week is actually seasonally positive, the rest of August and then September make up the worst period for investors (back to 1950).

2) The internals have been poor for the better part of 12 weeks. At some point the fact that the majority of stocks are struggling will likely have an impact on our mega cap market leaders. We see it here in the nasdaq advance/decline ($NAAD), which peaked in mid-May. When the markets are hitting ATH after ATH, our market leader (tech/nasdaq) should be putting up better A/D readings.

3) The macro environment is looking more and more risk-off. The Biden administration is coming completely unglued (more on that next). Our enemies are obviously paying attention. In addition, Fridays consumer confidence readings and this mornings Empire Manufacturing survey were “not good”. Outside of last March and April’s collapse, aka the onset of CV insanity, this is the biggest drop in the Empire Manufacturing sentiment ever.

VRA Bottom Line: We’ve raised some cash of late, putting us in a solid position to put funds back to work should our markets correct. We are VERY interested in adding to our VRA miners and energy positions as we aggressively look for our next opportunity in tech.

Our game plan is unchanged; with the markets nervous about geopolitical instability and the Jackson Hole Fed party (8/26–28), plus ongoing horrid internals we are waiting to add to existing positions and establish new positions. We’ve raised cash of late and are looking to redeploy it when the VRA Investing System gives us the signal. It certainly doesn’t help the Fed’s cause when they’re attempting to announce a QE taper into a collapse in consumer confidence and weakening retail sales, just as foreign central banks are withdrawing their plans to taper QE. And here’s an important point; the Fed has never initiated a withdrawal of QE when the University of Michigan sentiment reading is below 70 (as was just announced).

We repeat; there will be no serious tapering to speak of whatsoever this year or next. Certainly not with midterms coming. Especially with the humiliation that is the Afghanistan defeat. Our coward-in-chief has no coat tails to ride.

Big Trouble in China

We’re also learning this morning that the SEC appears to be going full bore against China. It started yesterday when they warned investors about owning Chinese stocks and continues this morning as they announce theyare looking into Chinese use of offshore structures for their US listings. This is EXACTLY what Trump warned about. Japan had 2 lost decades. Here at the VRA we believe it’s Chinas turn (but we’re also watching closely for what could be exceptional short term trading opportunities in both VRA and Parabolic Options.

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Twitter