VRA Investment Update: CPI Breakdown; A Relative Implosion in Consumer Prices. PPI Falls to 2.3% Inflation. US & Global Bull Markets.

/Good Thursday morning. Yesterday we learned that CPI inflation fell to 4.9% (year over year), marking the 10th straight month where inflation has declined (also known as disinflation). However, the core reading, which strips out food and energy (because who of us eats food or uses energy) dipped to 5.5% year-on-year, down from 5.6% in March.

This morning we learned that the PPI (producer price index) for April came in with a 12-month inflation rate of just 2.3% (wholesale level inflation).

It’s our continued hope that J Powell and his merry band of money printers are paying attention to the declines in both consumer and producer inflationary levels. It’s not just time to pause rate hikes, its time to start cutting rates. This morning 10 year yields are down to 3.35% while the Fed funds rate is at 5.25%. This level of inversion is screaming at the Fed to “cut rates….now”.

To further support the relative implosion in consumer prices, here’s the data. Consumer stress is dramatically easing when looking at the biggies; utilities, gasoline, food at home, and electricity costs (within CPI). Average of year/year change in all components has come back to near 0%, a HUGE improvement from >30% at worst point. Again, this is the classic definition of disinflation (h/t to Charles Schwab).

With the banking system (regional banks, that is) continuing to show stress (PacWest is down 22% this AM), its past time for the Fed to take action. One, get control of your regulatory staff and start supervising these failing banks and two; start cutting rates.

Fox Business Interview with Charles Payne

Last Friday I was on Fox Business ‘Making Money’ where I outlined our position on the markets (new bull market!), the fact that regional bank implosion is overdone and our long-standing position that Fed Chair J Powell is the wrong man for the job. Powell is likely the most dangerous Fed Chair in US history. It’s also likely that credit contraction from US banks will slow US growth.

VRA Market Update

Solid move higher yesterday in tech stocks and semis, with the Nasdaq 100 hitting an 8 month high and the Tech Sector ETF (XLK) hitting a new 52 week high.

When tech stocks are leading higher, with global equity markets hitting new 52 week highs while global PMI’s are hitting 16 month highs, while at the same time US housing stocks are hitting new highs and the largest 10 US stocks are up 64% on average over the last 7 months…if this is a bear market….

Moar Bear Market Rally, Please

US Housing Markets Hitting Fresh Highs

Yesterday the HGX (Housing Index) hit a new 52 week high, joining ITB (Home Construction ETF) which hit a new high last week. Housing is our most important leading economic indicator. When housing stocks are leading higher its “wildly” bullish for both the US economy and US stock markets. Housing is in a long term bull market. A megatrend move higher that should last into 2030 (at minimum) is underway.

We own NAIL (3 x Housing ETF), which is now up 205% over the last 6 months.

VRA Bottom Line: we are in a new bull market. We remain long and strong as we continue into the best year on record (pre-election years are hugely bullish). As always, we’re keying off of the semis, housing, transports and the generals. We have been aggressively long from the 10/13 bear market lows and will likely remain long, relying on the VRA Investing System to tell us when to take profits and/or add to/reduce positions.

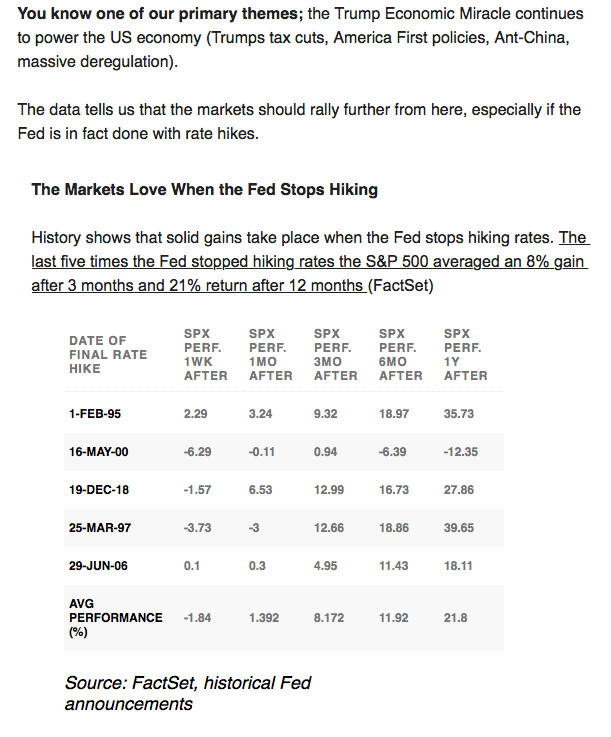

New Developments: we’ve had a target in mind for potentially taking profits on some of our ETF positions. It rhymed with “sell in May and go away”. May is not a great month for stocks, historically, however May has been higher 9 of the last 10 years. And there’s this:

Over the last 50 years, the S&P 500 has gained an average of 4.8% between November and April, and just 1.2% between May and October. However, this pattern fades over a shorter time frame.

- Over the last 20 years, the outperformance of November-April (over May-October) narrows to just 1%.

- Over 10 years, November-April has underperformed May-October by 1 percentage point and over the last five years, it's underperformed by 3 percentage points.

** Based on readings of the VRA Investing System, with 8/12 screens bullish and the remarkable leadership of the generals, we are removing our plan on taking profits this month. We’ll advise if/when things change. We remain long and strong.

Until next time, thanks again for reading.

Kip

Join us for two free weeks at VRAInsider.com

Please join us each day after the market closes for our Daily VRA Investing Podcast! Sign up for email alerts @ vrainsider.com/podcast

Also, Find us on Truth Social and Rumble