VRA Investment Update: Fund Flows & Analytics Point to Continuation of Move Higher. Strong Small Caps & Transports Have Bears Capitulating.

/Good Thursday morning. As we head into the final two trading days of June, in advance of both a new month and quarter, we expect to see significant fund flows into stocks from retirement funds, pensions, share buybacks, etc. The investing public is beginning to come back into stocks, as are institutional investors. This is a process and because we’re in just the first inning of this new bull market, the smart money play should remain to be “buy the dips”.

With our overbought conditions greatly reduced, my spidey senses tell me that front-running could result in a sharp move higher over the next two days (and into July). With Nasdaq and semis about to have their best first half in history, tech leadership remains firmly on our side. Importantly, the analytics continue to be in our favor:

Strong Analytics

- Over the last decade, July has been the strongest month of the year for the S&P 500, with gains in 9/10 years and an average gain of 3.3%.

- When the S&P 500 is up 10% through first 6 months of the year (its up 14% now) the last 6 months of the year have posted average gains of 12.4% (with gains 89% of the time).

Know this: when the analytics, technicals and economic fundamentals are all lined up…as they are now, with 9/12 VRA Investing System Screens bullish…with semis/tech leading the way higher, “fighting the tape” is a losing proposition.

This is Why the Bears Are Capitulating

As we headed into June, the bears were pointing to disappointing action in small caps and transports as major reasons they expected the markets to fall sharply. Here’s what we wrote in our 5/23/23 VRA Letter:

“Poor price action in small caps and transports

This too has been a concern of ours. Small caps are our most important domestic indicator of economic growth, as approx 70% of all revenue for co’s in the Russell 2000 come from domestic income streams.

If we’re going to have a recession, we typically see it in the action of small caps first.

Below (IWM, Russell 2000 ETF) we see a chart that is bullish, but still struggling to breakout. IWM is up 10% from the 10/13 lows, however remains slightly below its 200 dma, but also with a clear pattern of higher lows.

We have a position here and recommend its purchase (learn more at VRAinsider.com. A break higher across the 200 dma appears imminent which should then lead to sharp gains into year end. Small caps tend to be a second half of the year story.

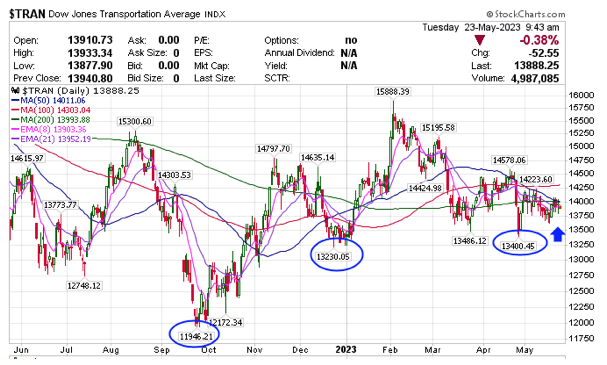

Our biggest concern of late has been the action in the transports, our second most important leading economic indicator in the VRA Investing System.

However, when we zoom out we see that the transports are still up 16% from last years lows (they in fact led the way higher) and are attempting a move back to the 200 dma. While we have no direct investments in the trannies, should they recapture the 200 dma…as we believe they will…bears will have a hard time remaining negative. if we’re going to have a recession, the transports will absolutely trade lower. Watching closely.”

So, How Have Small Caps and Transports Performed in June? With 2 days to go, small caps are up a very big 6.5% with the transports up an even bigger 12.7%. Just a massive month of June for these most important sectors, effectively blowing the bears (and their short positions) out of the water. As we’ve been covering, we expect this significant move higher to continue in small caps and aggressively recommend owning small caos along with our small cap VRA 10-baggers. When they say “a rising tide lifts all boats”, this is what they are talking about.

Final Thoughts

The pause/pullback in US markets over the last 10–14 days has had the anticipated effect of reducing our overbought status. Long time VRA Members know that we key off of the semiconductors. Below is a 1-year chart of SMH (Semi ETF), just a beautiful looking chart that has also telegraphed the move higher in our broad markets. On this pullback in SMH, volume has remained low (bullish) while each of our momentum oscillators (RSI, MACD, Stochastics, MFI) have worked off their extreme overbought readings. Stochastics (our most short term oscillator) is actually hitting oversold levels while MACD has gone to a short-term sell signal. What happens next in the semis will likely be our “tell” for the rest of the broad market. Bulls want to see the 21 ema hold (purple line).

VRA Bottom Line: we are in a new bull market. We remain long and strong as we continue into the best year on record (pre-election years are hugely bullish). As always, we’re keying off of the semis, housing, transports and the generals. We have been aggressively long from the 10/13 bear market lows and will likely remain long, relying on the VRA Investing System to tell us when to take profits and/or add to/reduce positions.

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast