The Wall of Worry Bull Market Continues. VRA Emotions of Investing. Housing is BACK! Shocking Sentiment Numbers.

/Good Thursday morning all.

A staple of the strongest bull markets of my career have been their ability to overcome all obstacles as they continue hitting new highs. In Wall Street lingo it’s called “climbing a wall of worry”. Powerful bull markets feed off of fear and worry.

Today, these fears dominate the financial MSM. We’ve been inundated by fears of trade wars, interest rate shocks (first, higher rates that would choke off economic growth, then falling rates, with an inverted yield curve), a global economic recession and of course the biggie; Trump Derangement Syndrome.

Through it all, a wall of worry has continued to propel US and global markets higher. We see exactly this in this 3-year chart of the Dow Jones. From Trump's election to the first significant top (1/18, beginning of US-China trade fears), our wall of worry bull market sent the DJ 43% higher.

Next, after US markets recovered throughout ’18, we then proceeded to hit new all-time highs again (9/18), just as the Q4 from hell kicked in. But, once again, propelled by a wall of worry, our markets recovered with a classic V-bottom move higher, resulting in new all-time highs in S&P 500 and Nasdaq.

This week, our markets have taken a hit, once again, on our primary wall of worry fear….US-China trade.

But folks, have you noticed that with each trade-related decline, they become less and less of a big deal? On Monday, the DJ plummeted more than 700 points intraday but recovered 200 points of those losses by the close. Then Tuesday, the DJ clawed back another 200 points, and we saw another solid day of gains yesterday. As the single best discounting mechanism on the planet, it looks increasingly likely that the markets have discounted the worst case scenario with China. It’s already baked in the cake.

No, it doesn’t mean that trade headlines won’t have the ability to rock the markets from time to time. But what it does mean, as I interpret the markets action, is that it’s increasingly likely that any hit to the US economy and US markets from trade tensions will be minimal, going forward. The markets have already picked the winner…it’s the US. China is on the losing end of this fight. Our wall of worry bull market will continue to take US markets to fresh all-time highs. The Trump Economic Miracle will prevail (easily, I believe) over US-China trade fears (that combined impact less than 4% of US GDP).

Again, Big..and we believe important…back to back recovery days in the US and global markets. Here at the VRA, we’re big believers in watching what the market actually does, rather than what old news and the talking head, 24-hour fake news cycle, tells us that it should do.

The latest round of US-China trade tensions resulted in a 1-day sell-off (Monday). Little more, really, as our markets have come solidly back. This morning…even on the backs of the news of Trump's executive order that could block all of China’s “communications technology” (see Huawei) in the US…one would think that global markets would be lower on this big news. But one would be wrong, as the Dow Jones is up over 200 points as I write. It’s not the news/propaganda that matters…it's the market's reaction to it.

HOUSING IS BACK!

We also learned this morning that US housing starts were 5.7% higher in April, with solid revisions higher in March as well. Housing has led our post 12/24 capitulation move higher. This is MOST important to us, as housing makes up an important component of the VRA Investing System. When the US housing market is vibrant, the US economy is on solid footing. Period.

Back in 2007, as we began warning VRA Members (and those who I spoke to from onstage, many thousands globally) about the coming economic risks, we focused on exactly this….the US housing market…which flashed literally 100’s of warning signs over the course of ’07. We know what happened next. The worst financial meltdown since the Great Depression.

But today, the US housing market looks much, much different. We see below, in the chart of HGX (Housing Index) that the housing sector has been THE market leader, from those 12/24 lows, with big 39% gains (and two golden crosses).

VRA Buy Rec NAIL (3 x Housing ETF) is +112% from those same 12/24 lows. When housing leads, the rest of the US economy follows. Highly bullish.

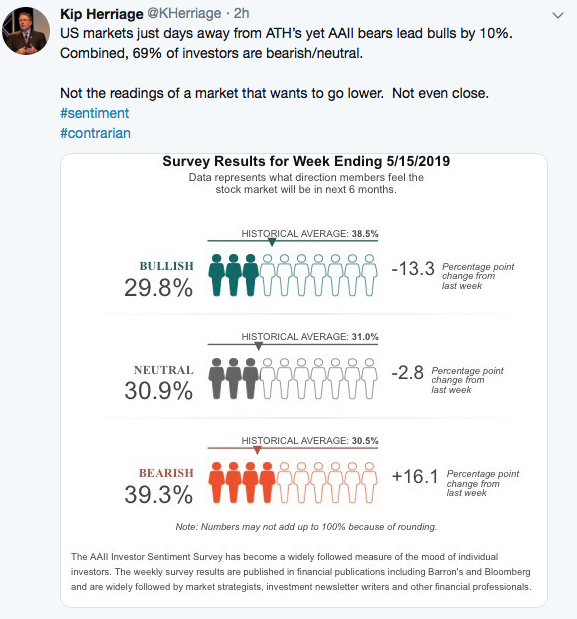

AAII Investor Sentiment Survey

I have just one word for last nights AAII Survey. STUNNING.

This has been my go-to survey for more than 30 years. It’s yet to lead me wrong. Again, these readings are stunning. We’re just days removed from all-time highs, yet these readings show 39% bears to just 29% bulls. It’s clear that the majority of investors are scared sh*tless by the stock market. And frankly, who could blame them? The last 19 years have seen the dot-bomb crash, 9/11/01, the Great Financial Crisis (which was in fact a 2 year Depression), 8 years of BHO, $9.5 trillion in added debt and $4 trillion in QE, and we’re just 5 months away from the worst December since the Great Depression.

But also know this; bull markets do not end until investors are euphoric about the markets. For the AAII Survey, that means readings of 65–70%, for weeks on end. We are light years away from a market top. Our targets are unchanged; 35K DJ by the end of 2020. 50K+ DJ by end of 2024.

Finally, for this morning, our VRA Update from a couple of months ago was our most heavily commented on in some time. “The Emotions of Investing”.

We’re reposting much of it again this morning for our newer VRA Readers (and old). My mentors taught me about the importance of managing your emotions, as much as anything else. Read and save. Teach this to your kids. Life-Changing stuff, as applied to investing (and life).

The Emotions of Investing…Nothing is More Important. VRA Approach to Crushing Mr. Market.

Wayne Gretzky said it best; “a good hockey player plays where the puck is. A great hockey player plays where the puck is going to be”.

As active investors, we want to crush Mr. Market. We have a strong desire to build our investment portfolios for a fully funded retirement account. We cannot do that if we skate where the puck is.

If we listen to the MSM, filling us with this fear, that fear, or the other fear, we’ll forever be buying when we should be selling and selling when we should be buying. We’ll forever be skating to where the puck is.

After doing this for 34 years I can tell you that it took me (at least) 10 years to get a handle on this most important subject. Understanding and controlling the emotions of investing. Nothing is more important. It’s a constant battle. Investing is as much art as it is science…artists are known for being temperamental and emotional…and nothing makes us more emotional than our money.

Think back to December. Investors sold out right at the lows. We know this because equity fund outflows hit an all-time record. Much of this selling occurred just as the Fear and Greed Index was hitting 2…yes TWO…another all-time record, indicating fear had gripped investors even more so than during the ‘08–09’ financial crisis. Remarkable.

If you were here with us then, you know that we were pounding the table to “buy buy buy”. We said exactly this during the last half of December, the worst since the Great Depression, and we said it often.

Investors that bought stocks in late December have massive gains to show for it. Unfortunately, that's not most investors. And even more unfortunately, this is how investment portfolios get wiped out…frequently.

I know, because I’ve done it myself. Tough lessons learned are always the best. Those lessons led me to the creation of the VRA Investing System. They led to getting my clients out of the market in late 1999, just before the dot-bomb, saving them $20–30 million in losses. They led to my warnings to everyone that would listen, beginning in 2006, at 100+ events all over the world, that “the coming financial crisis could wipe out stock markets and drive housing prices into the ground”.

And they led to my bottom calls in March ’09 and this past December. I’ll repeat, both bottoms will be all-time lows. That's how we played it in ’09 and that’s how we’re playing it now.

Where are investors mindsets today? Check this out…as Bloomberg reported this morning, even as global equity markets have gained $9 trillion in value this year, investors continue to pull money from the markets.

Remarkable. Even as our markets have surged higher, invests still aren’t believers. Fear continues to grip them. Our fake news financial MSM has much to do with this, along with the permabears that have taken over social media. Combined, investors have a level of anxiety that may be the highest yours truly has ever witnessed.

But folks, don’t believe it. It's one big psyop. And it’s designed to keep investors afraid and in cash. But trust me on this; as the markets continue to move higher. our financial press will start to become more bullish. We’ll hear them begin to whisper about the global economic recovery. Then, as the DJ crosses 30,000, we’ll hear them start to say “hey, maybe the good times are returning”. Then, as the DJ crosses 35,000, we’ll hear them join the VRA’s major global macro point of “wow…it does appear that populism/nationalism is better than globalism.”

Then, likely in 2023–2024, as the DJ approaches 50,000, literally everyone and their mother will be wildly bullish on stocks. We’ll hear “100,000 DJ is even possible”!

And that’s when we’ll be selling and taking profits. It’s the very nature of investor sentiment…the very nature of fear and greed…the very nature of the emotions of investing.

In addition to using the VRA Investing System to crush Mr. Market with our leveraged ETF’s, we own five story stocks for the opportunity of 500% to 1000% gains..something I’ve specialized in my entire career. Updates coming soon.

Make sure and do two things; sign up for our VRA 14 day free trial to ensure you are positioned correctly and listen to our daily VRA Investing System Podcast (sign up at vrainsider.com/podcast).

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Sign up to Join us daily for our VRA Investing System podcast

Learn more at VRAInsider.com