US-China Trade Morphing into Economic War….one that China Will Lose badly.

/Good Thursday morning all.

Our major U.S. indexes opened lower this morning as the U.S. administration is applying maximum pressure on China via attempts (along with US allies) to essentially shut Huawei down. Huawei is huge. As the largest telecommunications manufacturer on the planet and second largest manufacturer of smartphones (behind Samsung), Trump is now applying maximum leverage against the Chinese.

It’s still not a trade war…but it’s quickly morphing into all-out economic war vs China. This is a war that China cannot win. If you’ve read The Art of the Deal, you may recognize what Trump is doing here. In order to get the deal you want, find the pressure points on the other side and apply maximum pressure. He has our allies around the world, through governments and corporations, backing him.

Take a few minutes and watch this interview with Oculus founder. Trump is on the side of the majority in silicon valley….we also see this in actions from Google and Microsoft.

I have been in the camp that China will not be dumb enough to repeat the country killing mistakes that Japan made, beginning in the early 90’s. If I am wrong, then China is in for a world of hurt over the next 1–2 decades. For now, Chinese markets are still up in the 20% range in 2019, with technical buy signals intact.

Heres what’s on my mind; take some time to read this article, featuring Steve Bannon’s views on US-China. Without Bannon’s help, Trump is almost certainly not the president. Bannon still has the ear of the president, as just as he does with pro-populism leaders around the world (big EU elections this week!).

As you’ll read, Bannon says this goes much deeper than trade-related issues. This is essentially about taking China down…hard.

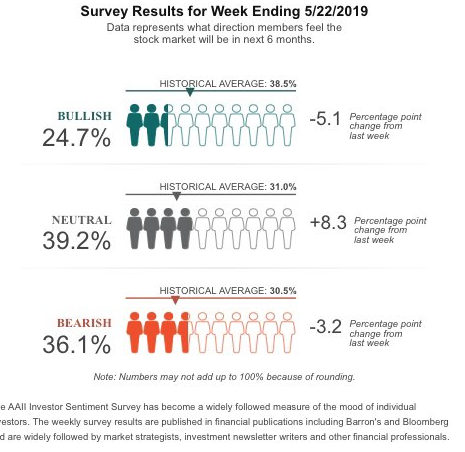

Consumer Sentiment

Check this out…with the markets just 4% from all-time highs, look at last nights AAII Investment Sentiment Survey readings. 24.7% bulls and 36.1% bears. The level of negative sentiment is amazing. And no, this is NOT a sell signal.

We’re also seeing the continuation of the pattern we’ve been discussing here of late, namely that our markets continue to rally off of their lows (on down days), rather than finishing weak into the close of trading. And our observation remains that each round of “China trade war” hysteria impacts our markets less and less. We continue to see these events as important market tells.

The VRA Investing System remains at 9/12 screens positive. Dips must be bought, in our VRA buy recommended positions.

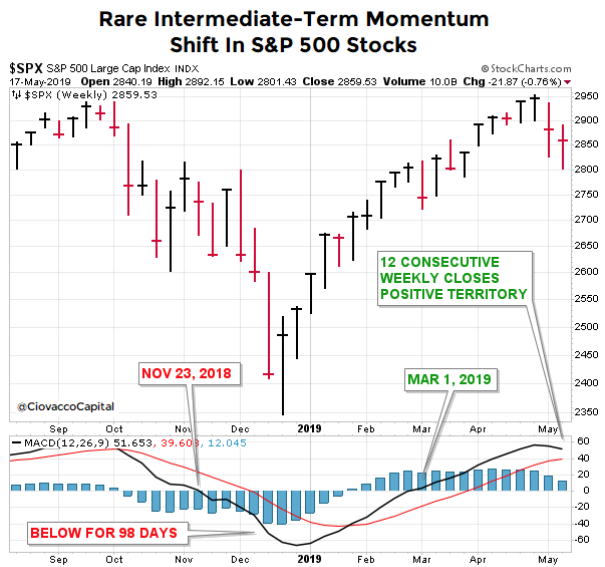

The following chart and analytics comes from CC Market Analysis and helps to confirm our bullish market views (short, medium and long term). What we see below is a chart of the S&P 500, focusing on the technical indicator called the MACD, or the “moving average convergence divergence” indicator. We use this indicator to confirm whether our moving averages are giving a buy signal or sell signal, and it can be applied to the broad market, sectors or to individual stocks. The MACD has just completed 12 consecutive weeks in positive territory. Keep reading to see what this means…

Bottom line; 12 straight weeks in positive territory for the MACD has occurred just 16 times in the history of the S&P 500, producing an average gain of 29% over the next 2 years. Another highly bullish piece of market analytics.

Populism/nationalism beats globalism, hands down!

Finally, this past weekend's Australian elections provided more evidence that the VRA’s forecast for a global bull market on steroids is playing out, a major geopolitical theme of ours, as conservative incumbent Scott Morrison shocked the pundits by beating liberal, big government, climate alarmist Bill Shorten.

Again, the election in Australia is another important piece to the puzzle for our major macro geopolitical forecast for a long term, global bull market. Our theme is unchanged; populism/nationalism beats globalism, hands down.

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Sign up to Join us daily for our VRA Investing System podcast

Learn more at VRAInsider.com