VRA Weekly Update: December Jobs Report. Trump Economic Miracle…Our 15 Year Nightmare is Over. SPX 5000.

/Good Friday morning all.

December's employment data came in with 145,000 jobs created (slight miss) and unemployment rate of 3.5% (50 yr low). The Trump Economic Miracle continues.

If you’ve been with us over the last 2–3 years you know we’ve been ultra bullish on the US economy and stock market. Our Dow Jones 50K+ target has been in place since 1/17 and for the majority of the last 2 years we were in the big minority…but that’s changing, quickly. Employers, employees and investors are waking up to the probability that our 15 year nightmare (2001–2016) is finally over.

You know the drill well; 9/11, recession, Iraq WMD’s, $7 trillion spent on Iraq/Afghan wars with more than 6,000 US soldiers killed and 130,000 injured, $4 trillion in QE, $14 trillion in added gov. debt, financial/housing crash, 2 year depression, Obamacare and opioid crisis.

You’d have to be heartless not to understand the negativity of investors…the continued equity outflows…little desire for anything that has to do with the stock market. But this is also the evolution of a bull market. Slowly but surely, animal spirits are returning as the public starts to buy into Trump’s America First policies…increasingly confident that “things are actually getting better and will continue to improve”.

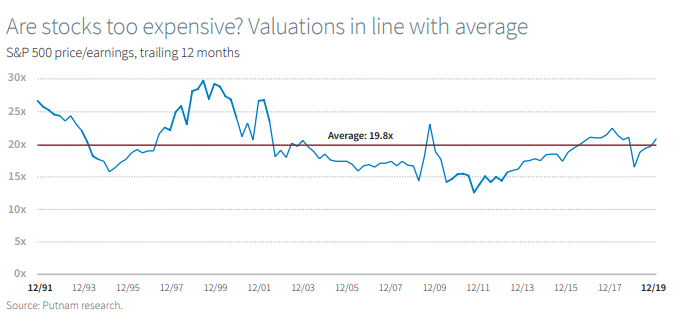

We’re no longer one of the few calling for a 5–10 year mega bull market in US and global stock markets. Case in point; this morning Putnam’s CIO is out with his estimate for S&P 500 5000 in the next 3–5 years (below). And this is no pie in the sky target…it’s based on exactly what we’ve been discussing in these pages; P/E multiple expansion, earnings growth of 8–10%/year and continued low rates. It’s just math.

BTW, a 5,000 SPX gets us to 44K Dow Jones. We’re sticking with our Dow 50k + target. And remember our other major point of the last 3 years; as the US leads, the world follows. We’ve entered a special period folks. After that 15 year stretch of awfulness, I think we can all agree that we’re due.

Putnam CIO with 5000 SPX Target

A bit longer term is this call of the day from Shep Perkins, chief investment officer for equities at Putnam Investments. He argues the S&P 500 (SPX) could reach 5,000 quicker than you might imagine, given that it only reached 3,000 in July (and closed Thursday at a record 3,274.70).

In the Boston fund manager’s first-quarter outlook, Perkins says price-to-earnings multiples are in line with their average in recent decades, and there is a reasonable case that multiples will expand, fueled by historically low long-term bond yields.

For much of the second half of 2019, the dividend yield on the S&P 500 was higher than the 10-year U.S. Treasury yield (BX:TMUBMUSD10Y) — compared with bonds, stocks have almost never been cheaper.

Technology giants including Facebook (FB), Google owner Alphabet (GOOG), Cisco Systems (CSCO), Intel (INTC) and Apple (AAPL) have “undemanding valuations,” says Perkins, while sectors including financials, energy and basic materials, which account for a fifth of the S&P 500, are priced well below historical average.

And what if earnings accelerate, say driven by a pickup of global growth and a weakening dollar? “With earnings growth of 8.5% per year and a 26x P/E multiple, the market would surpass that mark inside of three years. This is hardly the base case, but it’s also not an extreme scenario in the event bond yields remain depressed,” Perkins says.

Even if a recession hits, the S&P 500 could reach 5,000 in five years, particularly if that downturn came this year or next, he adds.

Finally, in Wednesday’s podcast, Tyler and I broke down the reasons why our bull market is just beginning its melt-up phase. Tesla is a microcosm of today's bull market, the most hated bull market of our times. Like Tesla, which the bears have gotten exactly wrong, US equities continue to remain out of favor with investors. 17 minutes….give it a listen.

https://soundcloud.com/user-640389393/join-kip-tyler-for-todays-vra-investing-podcast-jan-08-2020

Until next time, thanks again for reading…have a good weekend

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/17 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast