VRA Weekly Update: US-China Trade Deal is a Big Deal. Global Bull Market Ramping.

/Good Thursday morning all. Impeachment headed to senate…no one seems to care…as it should be. US-China phase 1 trade deal…no one seems to care…that’s a major mistake in our view. To understand just how big of an accomplishment this is for the future of the US economy and US-China relations, listen to Tyler’s podcast from yesterday afternoon.

https://soundcloud.com/user-640389393/vra-podcast-tyler-herriage-daily-investing-podcast-jan-15-2020

For 2 years the MSM fear-mongered us to death over “US-China trade war”…it was never a trade war…it was always a buying opportunity. Now the benefits begin to kick on. AKA “melt-up” continues.

- Nationalism/populism beats globalism. Long term mega-important trend underway

- US leads, the world follows. Global bull market just kicking in

- Our 15 year nightmare is over. It’s time for 1–2 decades of prosperity, peace and optimism

- The Trump Economic Miracle = DJ 50,000+

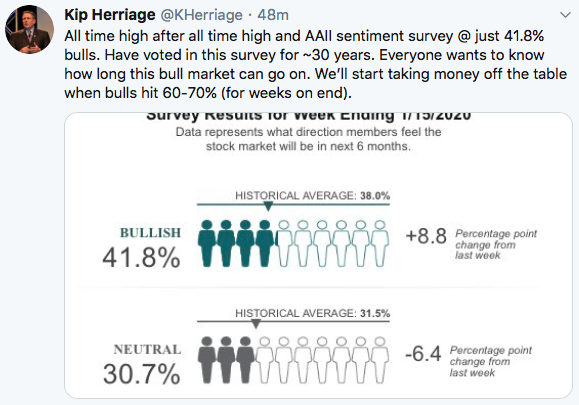

Last nights AAII sentiment survey came in at 41.8% bulls, 27.5% bears and 30.7% neutral. My thoughts below. Wake us up when bulls hit 60–70%. At that point, fund flows will be overwhelmingly euphoric.

OIL & Energy Stocks

Below is a 1-year chart of oil. The bullish channel below has developed from last October with oil back to its lower channel line now. It’s also hit extreme oversold levels. We expect the move higher to continue from these prices. A move to $64 our bogey.

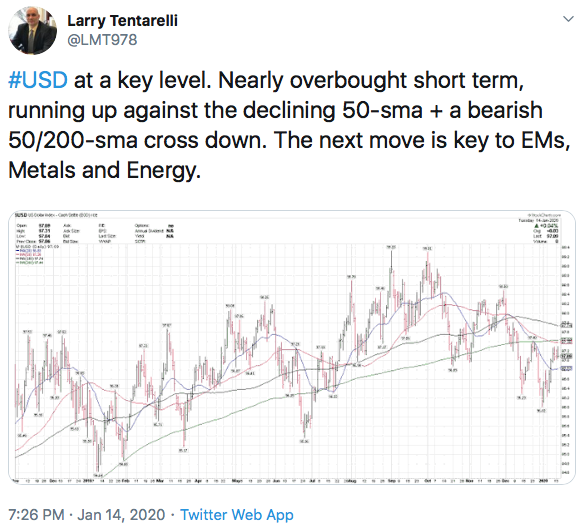

Commodities have a high correlation to the US dollar. As my friend Larry Tentarelli (excellent follow) points out below the dollar is reaching ST overbought levels and nearing its 200 dma, which should serve as resistance. A move lower would be positive for oil and metals.

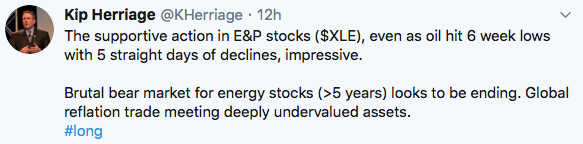

Increasingly likely that the 5 year bear market in energy stocks is ending.

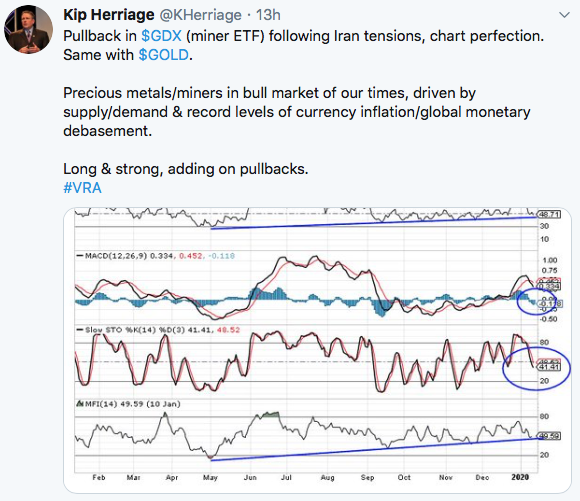

Yesterday, Ray Dalio’s hedge fund Bridgewater (largest on the planet at $160 billion) is recommending gold with a target of $2000/oz. Obviously, we agree with Ray.

VRA miners must be owned here. Copper is hitting 7 month highs as the global reflation trade builds.

Here’s the chart of GDX. In risk-on environments, like this one, its not uncommon for PM’s/miners to retreat. Below we see GDX approaching a supporting trend line back to last June, when the sharp move higher began. It’s important that this line holds. I expect it to. As of today we are exactly at supporting trend lines for RSI and MFI, with stochastics in oversold territory. Repeat; this group is in a major, multi year bull market move higher.

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/17 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast