VRA Weekly Update: Wall Of Worry Move Higher. How Serious is the Coronavirus?

/Good Thursday morning all. Bull markets love climbing a wall of worry. Bull markets actually perform better when the fear seems greatest, another testament to the power of (contrarian) sentiment as market mover. Our current bricks in the wall? Trumps impeachment trial in the senate started this week (I know…yawning snoozefest). We also have a new China virus that took the Hong Kong stock mkt down 1.8% (not a yawner).

The coronavirus appears to be our new, and quite possibly legitimate, brick in our wall of worry. Fears that this could have the same impact as the SARS virus from 17 years ago or the Asian flu virus from 14 years ago, are beginning to spread. Chinese markets were down another 1.5% to 3% and European markets off .50% across the board.

More than anything it’s the fear of the unknown. When you hear news that two Chinese cities the size of Houston (or larger) have been quarantined, we are forced to pay attention.

This morning Marketwatch is out with a good piece on the impact of viral outbreaks on the markets. After some initial shocks, you might be surprised to learn that the bull markets of ’03 and ’06 continued moving higher (with 10–20% gains).

We’re paying close attention….but officially, we will continue to treat (overbought) pullbacks as buying opportunities. And here’s what we’re on the lookout for…

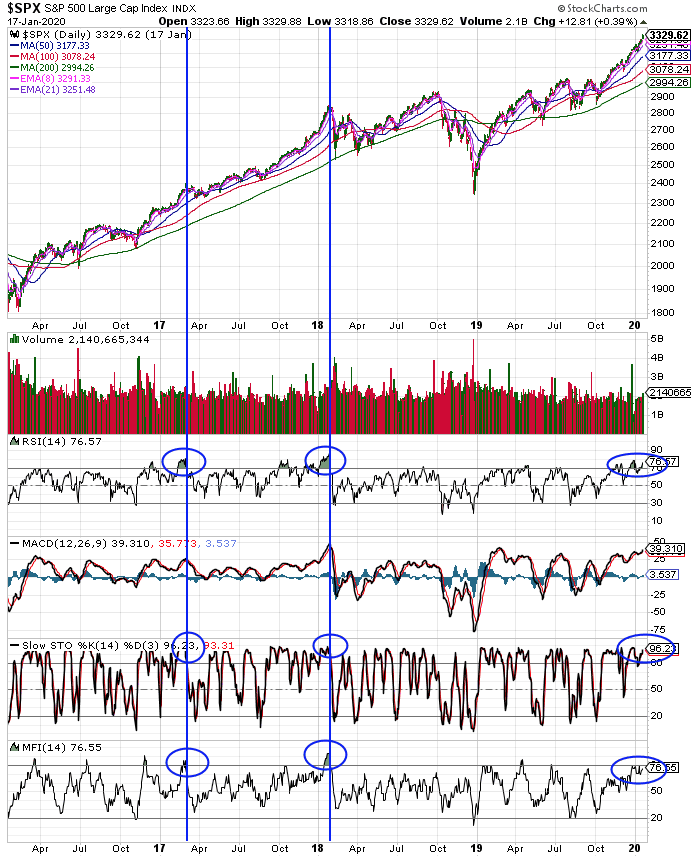

The S&P 500 is hitting extreme overbought levels. Below is a 3 year chart of SPX. The 2 blue vertical lines mark the highest degree of OB levels we’ve seen since Trump was elected. The first (3/17) resulted in only a short pause, then straight up again. The second (1/18) we remember well….the Dow fell 3000 points inside two weeks.

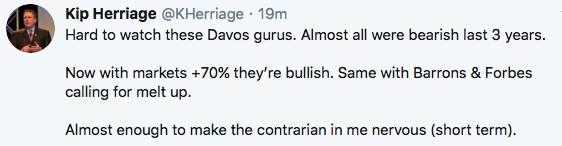

We have yet to reach those same OB levels, seeing Barrons and Forbes headlines like these from over the weekend…along with Davos billionaires on CNBC that have now turned aggressively bullish (after hating the Trump Economic Miracle for 3 years) does tend to trigger our contrarian alarm bells.

While yes, we remain at extreme OB levels, we continued to see the reasons to be bullish again yesterday, wherein a mostly flat market new 52 week highs to lows came in at 581–68. These readings are building…getting stronger across the board…almost certainly telling us that (as Tyler likes to say) “new 52 week highs tend to beget more new 52 week highs”.

We’ll start getting concerned about the market when the internals begins to fade and when leadership starts to falter.

Yesterday, our two primary leaders, housing and semi’s finished higher on the day. TXN (Texas Instruments) reported earnings (mixed) and INTC (Intel) reports after the close today. If the semi’s can continue to move higher, nothing is stopping this bull market. That’s our continued view…the techs lead the market and semi’s lead tech.

Internals and leadership…nothing matters more. It’s not more complicated that this.

The Dow Jones has a 30,000 magnet. We’re seeing lots and lots of short term traders calling for a top here. When they’re forced to cover their shorts, that should be enough juice to get us to 30k, similar to the Tesla short squeeze we’re witnessing today.

Quick Hitters:

1) Oil has fallen out of bed…yes, due in part to coronavirus fears…but we see this as a technical correction that should be bought. The global economy is in the early stages of “significant” economic recovery…oil (and commodity pricing) will benefit greatly.

2) We continue to like precious metals/miners here. GDX (miner ETF) put in back to back to back days this week of “outside days”…where the high/low of each day surpassed the previous days…all with a bullish bias. It’s time for this group to move.

VRA Bottom Line: we remain bullish in short, medium and long term. 10/12 VRA screens remain bullish. Once we reach this level of OB, risks begin to rise…simply not as great a time to buy the broad market as it was last year. Our VRA 10 baggers and VRA small-mid cap growth stocks each remain a strong buy.

Until next time, thanks for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/17 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast