VRA Investment Letter: Readings of Extreme Fear, Everywhere We Look. Stay The Course.

/Good Friday morning. Over the last couple of weeks we’ve talked about the reasons for this short term liquidity-led shakeout, including yesterdays massive intraday reversal which began exactly as (fired) Fed Governor Lisa Cook was giving a speech where she warned extensively of a “sharp market reversal” (In no way do I believe this was a coincidence). However, what’s more important this morning is covering where we are and what comes next.

The Fear & Greed Index hit “4” last night (last:7). This indicator is highly useful at extremes like this one. The lowest reading on record was “2”, on Christmas Eve 2018 (the Q4 from hell, brought to us by J Powell…which marked the lows) and another reading of “4” exactly at the 10/13/22 bear market lows. The current level equates to the fears of finding a monster beneath every bed. High probability contrarian indicator. The last time the S&P 500 was just 5% away from a record high, with extreme fear readings like this, the S&P 500 rallied 200 points in 48 hours.

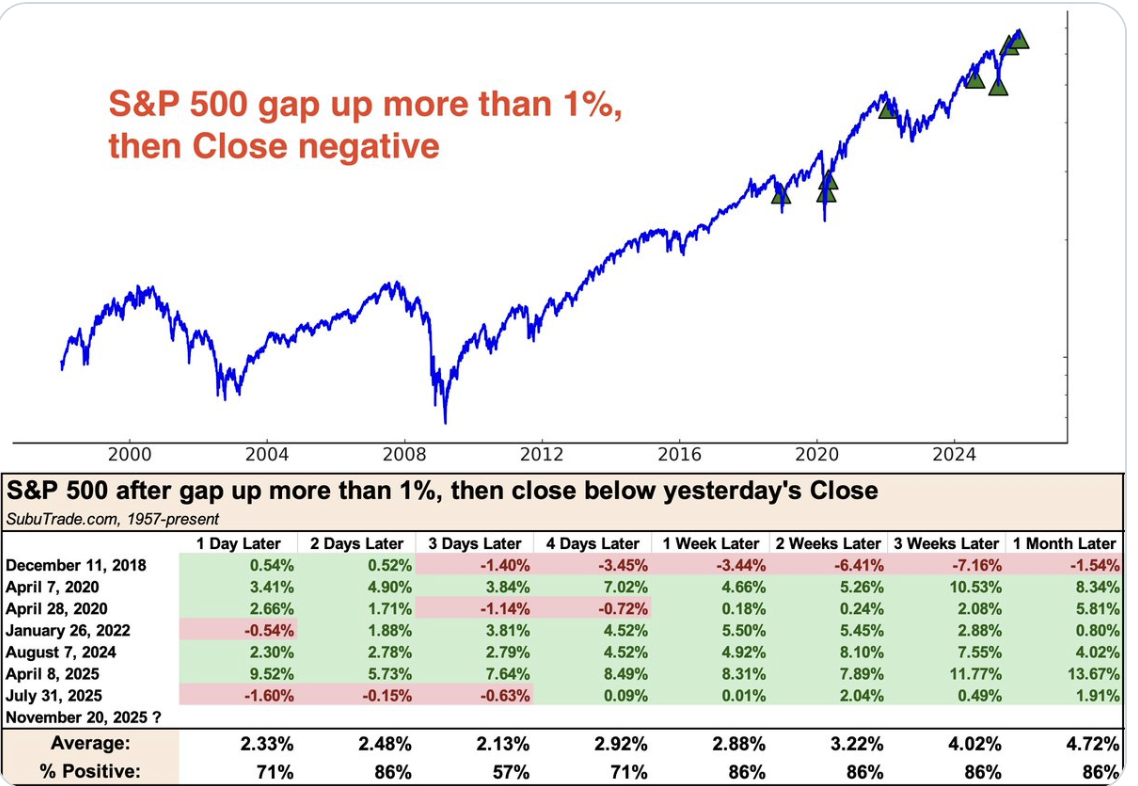

Yesterday’s reversal was a shock to the senses. Here’s every case where the S&P 500 gapped up >1% at the open only to close negative.

One week later the market was up 86% of the time with an average gain of 2.88%. One month later it was up 86% of the time with an average gain of 4.72%.

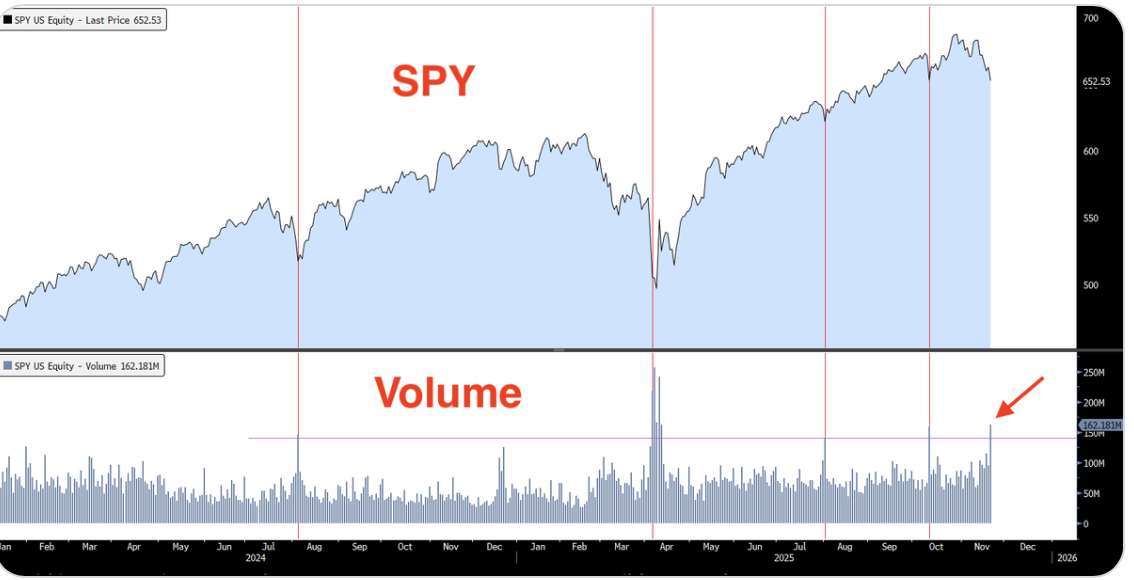

S&P 500 volume today hit the highest level since April 7 (tariff mania crash lows). High volume readings like this tend to take place close to market bottoms.

Extreme Oversold: NASDAQ’s McClellan Oscillator fell to -62 today. The last 20 times this happened, Nasdaq rallied 85% of the time 1 week later with average gains of 2.8%.

Finally, as to our short term liquidity issues (brought to us by the shutdown, the $1 trillion stuck in the TGA and the Fed dallying with a change in rate cut policy), this morning we heard from NY Fed President John Williams who seems to have had a change of heart on the December rate cut (positive). We also see below that Treasury cash is down $100 billion from govt shutdown peak, with Fed reserves rising to $2.92TN, now a full $100 billion off of the lows.

This tells us that the money stuck in the TGA is beginning to flow back into the system.

VRA Bottom Line: we’ve seen short term damage, brought to us by (short term) liquidity issues, all hitting at the same time. The analytics above point to a near term bottom that’s close at hand. While we aren’t fans of buying on Firdays, might we finally get an opportunity to have a true Monday capitulation market bottom?

Finally for now, nothing has changed with our Big 3. The Trump Economic Miracle, the Innovation Revolution and an absolute ocean of (medium-long term) liquidity in the US and global economy. Members of the Trump administration seriously believe that Q1 & Q2 2026 will be when the country feels the full benefit of Trump’s economic policies and the Atlanta Fed just raised their Q3 GDPNow estimate to growth of 4.2%, a new cycle high.

The VRA System remains at 9/12 screens bullish and we want to see the semis/tech and Bitcoin bottom and then lead higher. These are BY FAR the most important tells to watch.

We own great companies that will see tremendous growth in their share prices over the next 3 months to 3 years. We are EARLY in this generational bull market with highly diversified assets that will benefit the most. Stay the course.

Until next time, thanks again for reading, and have a good weekend all.

Kip

Join us for two free weeks at VRAletter.com

Please join us each day after the market closes for our Daily VRA Investing Podcast! @ https://vraletter.com/podcasts/