VRA Investment Letter: The PSYOP of Negativity Can't Stop This Bull Market. Primary Trend of Markets Remains Higher, Interest Rates; “Sharply Lower”.

/Good Thursday morning. Following yesterdays strong jobs data and solid open we had a mid-day shakeout that took the markets from 1% higher to 1% lower, in fairly short order…most all while I was out walking our Lab (Brady). I immediately checked a single quote on my phone; SMH (Semi ETF). When I saw that the semis were still higher by .70%, my concerns quickly faded away. When the semis are leading higher, the rest of the market eventually catches up. BTW, the semis finished up 2.5% on the day. The primary trend of the market remains “higher”.

PSYOP of Negativity

We’ve covered this ongoing phenomenon often over the years…we covered it in “The Big Bribe” as well. There’s a long running PSYOP of Negativity in place and it’s designed to make sure Americans remain fearful about the economy/markets and their future…especially with Trump as president. When Biden was president we were given phony jobs data from the BLS….filled with lies, a ton of government employees and of course, untold millions of illegal aliens. The media lapped it up. “Best jobs markets ever”, they propagandized day after day.

Did you notice a difference with yesterday’s strong jobs data…with Trump as president? “A muddy jobs picture”…”ok, but uncertain and concerning”…this was the coverage throughout the day from Bloomberg and CNBC. Let’s do a quick recap of some recent economic data we learned just yesterday:

- As a percentage of the total work force, federal employees are now at their lowest levels since 1966 (approx 600,000 federal employees have exited over the last year). Gee, I wonder if this might have had an impact on the jobs data...

- Tariff revenue is up $124 billion, a whopping 304% increase from the same period in 2025.

- Tariffs have helped put a dent in the pace of the US budget deficits as the shortfall in January totaled $95 billion, down 26% from a year-ago.

- Finally, we learned yesterday that our trade deficit is down 78% from when Trump took office. China now makes up about 7% of our imports, down from as high as 27%.

Smart money investors know what’s what; getting your views from the MSM can be deadly for both your investment portfolio as well as your psyche. The US economy is on fire…and that’s the truth.

VRA Market Update

Beginning 3 weeks ago we took profits in our ETF Strategy as we saw near term risks on the horizon. Since then, we’ve worked off our extreme OB conditions which culminated last week in true capitulation bottoms in Bitcoin, software and momentum stocks. As outlined with VRA Members last week, the reversal in these groups is broad market bullish, as demonstrated by the Dow Jones 1200 point move higher on Friday (surpassing 50,000 for the first time) along with ATH’s in the equal weight S&P 500, transports, banks and energy.

In addition, the “Kevin Warsh is a hawk” fearmongering never made sense to us. There’s a near zero percent chance that Trump would have nominated Warsh as his new Fed Chair if Warsh actually wanted to hike rates. Our most pressing near term concern remains Iran, as Trumps military armada continues to grow largest still. Should we get another attack on Iran, like the last time, we except it would be short-lived and represent another buying opportunity.

Our call from the beginning of the year was that 2026 would be a special year, with gains of 30-50%. Now, after this latest shakeout, short sellers (from close to record levels) have already begun unwinding their short positions. This gives us twice the bang for our buck as the shorts must now buy “twice”; first to cover their short positions and then, to flip and go long. This is known as rocket fuel for the coming move higher.

Powerful rotational themes, as we’ve seen from the birth of this bull market in late 2022, are unique in that they only happen during bull markets. They protect the broad market, as individual sectors get rotated into and out of. This is why we continue to call this “textbook bull market action”.

VRA Bottom Line; this remains a generational bull market market that’s being led by a US economy with GDP growth that will soon surpass 5%, rock solid corporate earnings, extraordinary rotational strength and a global reflation trade that continues to point to a global bull market of size and scope with years to run.

Quick Hitters

1.) Primary Trend of Interest Rates; “Sharply Lower”

Just after Trumps re-election, we made three big calls. 1) buy stocks; we’re in a generational bull market, 2) the US dollar is going sharply lower and 3) interest rates have peaked and will plummet into 2030.

Below, in this chart of 10-year treasury yields, you can see the peak in rates (from almost exactly Trumps inauguration), followed by a repeating pattern of “lower highs”. When Trump was elected the 10-year was 4.8%. Today it’s 4.19%. Because the 10-year Treasury yield is basically the benchmark for lending, everything else prices off it. It’s long enough to reflect expectations about growth, inflation and Fed policy, but not so long that it gets lost in the long term noise of 30-year bonds. Investors, banks, mortgage lenders, companies…they all watch it like a hawk.

– Mortgage rates? Tied to it (add a spread, usually 1.5–2%).

– Corporate borrowing? Priced relative to it.

– Equity valuations? Discount future cash flows use it as the “base rate”.

– Global markets? It’s the anchor; when 10-year yields spike, risk assets bleed; when it drops, everything rallies.

VRA Bottom Line: The 10 year is the sweet spot where supply, demand, and sentiment collide. No other rate is as important. Once Trumps new Fed Chair Kevin Warsh is in place, if not before, we expect 10 year yields to fall below 3.5% (by year end) with a move below 2.5% by the end of 2027. Trump and Bessent have “lower rates” as one of their top priorities…and these two tend to get what they want. This move lower in rates will be extraordinarily bullish for stocks and the broader economy

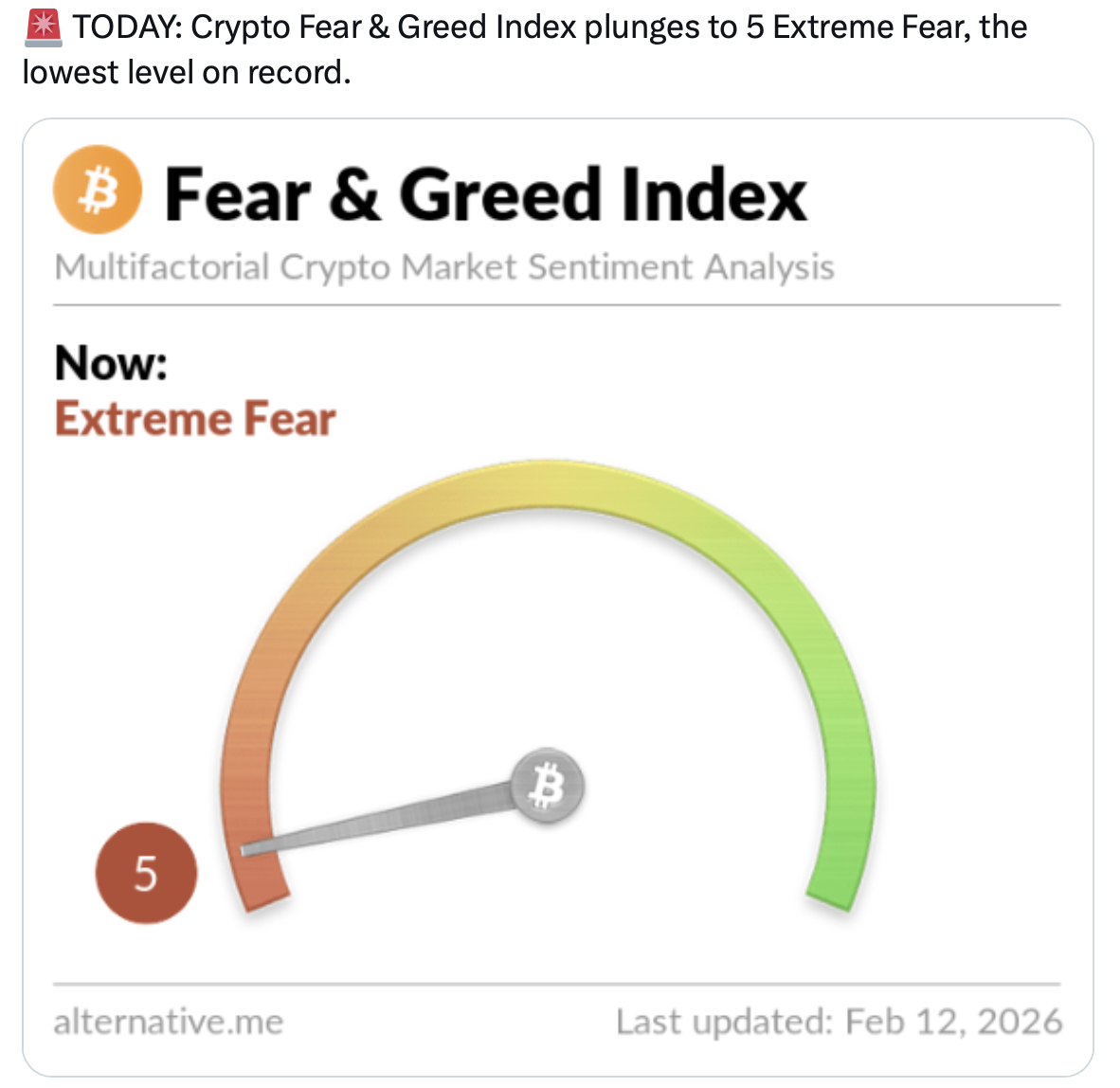

2.) Bitcoin: Extreme Fear on Steroids

Last Thursday we told you that BTC had hit its 3rd most oversold levels in history (on RSI) and that we believed the lows were in place. This morning we learned that BTC has hit its lowest level in history on the Fear & Greed Index with a reading of 5. Again, the lows are in place. Last: $68,000

3.) Here’s my new interview with true patriot and defender of Americas core values, Wayne Allyn Root. It was a long ranging 20 minute segment where my great friend of 23 years and I cover a fair amount of territory. Thanks Wayne!

https://rumble.com/v75mezi-kip-herriage-joins-wayne-allyn-root-on-war-zone.html

Until next time, thanks again for reading.

Kip

Join us for two free weeks at VRAletter.com

Please join us each day after the market closes for our Daily VRA Investing Podcast! @ https://vraletter.com/podcasts/

Also, Find us on Twitter and Rumble