VRA Investment Letter: Q3 GDP 4.4%. The “Big 3” Continue to Power the Economy. Gold and Silver Stand Alone. Trump: Greatness is Our Birthright.

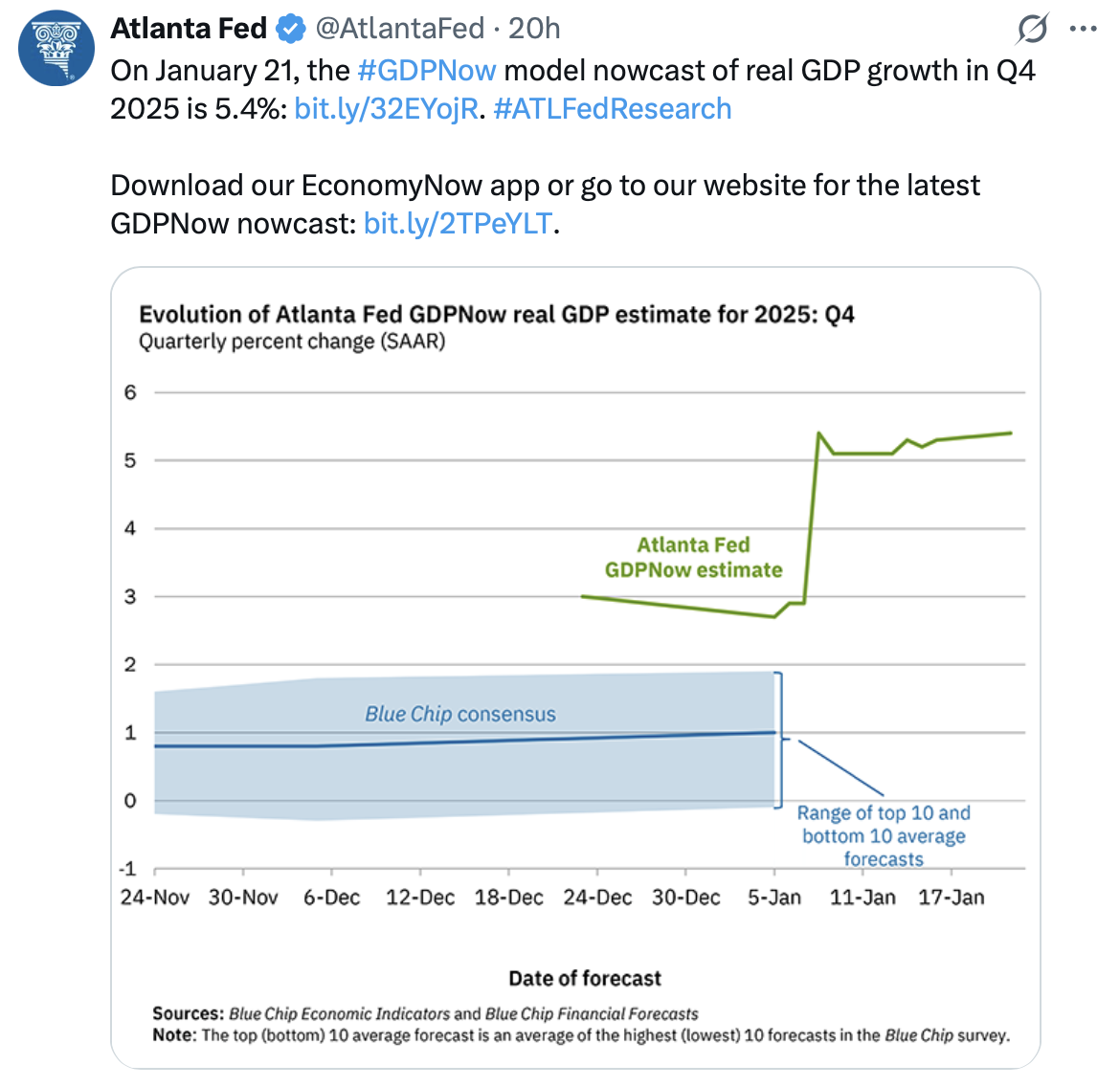

/Good Thursday morning. Breaking: Final Q3 GDP is in with growth of 4.4% vs estimates of 4.3%. Beginning last summer we were the first strategists in America (that we are aware of) that began forecasting GDP growth would surpass 5% by Q3 2026. With the Atlanta Fed’s Q4 GDPNow estimate of 5.4% growth, it looks like the Trump Economic Miracle will beat our GDP estimates to the punch.

Following Tuesday’s sharp selloff, our near term (counter trend) concerns about Japan and Greenland look to have been put to bed with the announcement the US has the framework of a deal with Greenland. As to Japan, the surge higher in the Nikkei 225 (which finished up 1.7% overnight) has the Nikkei just 1.4% from all-time highs. The markets are a discounting mechanism and are showing no signs of an impending melt-down in Japan.

While JGB’s will remain as one of our top blackswan event risks, it now looks like Scott Bessent's warning about the sharp rise in JGB yields may have been a bit of a throwaway line, rather than a warning of more ominous things to come. With yesterday's blast higher in US markets…which took place on excellent internals (led by the semis)…all appears to be right with our markets, once again. The shakeout also helped to remove our heavily overbought readings, which removes our concerns about our positions in the semis (find out what those are at VRAletter.com)

As Tyler covered in detail on his podcast, yesterday’s action also produced excellent broadening action featuring ATH’s in small caps, trannies, the semis and much, much more. We feature this relative strength chart of the semis to S&P 500 often, as it’s our go-to indicator for market direction. This chart, more than any other that we are aware of, is THE tell for which side of the market we want to be on. As you can see, SMH:SPY hit a new high again yesterday. Combined with 10/12 bullish VRA System screens, we will remain long and strong this market.

VRA Bottom Line: while short term shakeouts are attention-getting, it’s important to remember that we see these as “counter trend” moves, rather than our “primary trend” which remains incredibly bullish. We continue to forecast that our “Big 3” of the Trump Economic Miracle (tax cuts, deregulation and tariffs), the Innovation Revolution and an absolute ocean of liquidity, will continue to power our markets higher. Our forecast remains that 2026 will be an historically important year, as the Innovation Revolution fully arrives on Wall Street, which we expect will produce gains of 30% in S&P 500 and 50% in Nasdaq. History doesn’t always repeat but it often rhymes and like the roaring 1920’s, the Roaring 2020’s are very alive and very real.

Gold and Silver Sit Atop All Asset Classes

Gold and silver are now #1 and #2 as the largest asset classes on the planet. Tyler told me this yesterday and I did a double-take….I literally hadn’t stopped to think about this.

Golds total market cap is now $34 trillion with silver topping $5 trillion. To my fellow gray hairs that have been stacking gold and silver over the decades, congrats! Your view that “real money would ultimately rule the day” has been proven exactly right. We were abused over the years; called things like “cavemen with outdated thinking.” Or as Warren Buffett said “gold has no utility…anyone watching from Mars would be scratching their heads.” Sorry Warren, you were exactly wrong about both gold and bitcoin. Two glaringly large misses. In fact, if Warren had simply put his entire portfolio in gold over the last 25 years his returns would have greatly surpassed the returns he actually pulled in.

Remember, gold and silver are moving higher because we’re now witnessing true price discovery for the first time in decades. In fact, were it not for a ridiculous amount of manipulation by major money center and central banks, gold and silver would have been at their current prices a full decade ago. In addition, we continue to expect Trump & Bessent to announce a monetary reset (of sorts) over the next year (or so) where gold/silver/bitcoin are used as a partial backstop/backing to new long term US treasury offerings.

Combined, the demand for each will continue to be “intense”.

Our view remains that these moves higher, featuring true price discovery, will continue to build. By about 2030-2032 we expect gold to trade up to $15,000 with silver surpassing $300. Both estimates could easily price to be on the low side.

Trump -Davos. Greatness is our Birthright

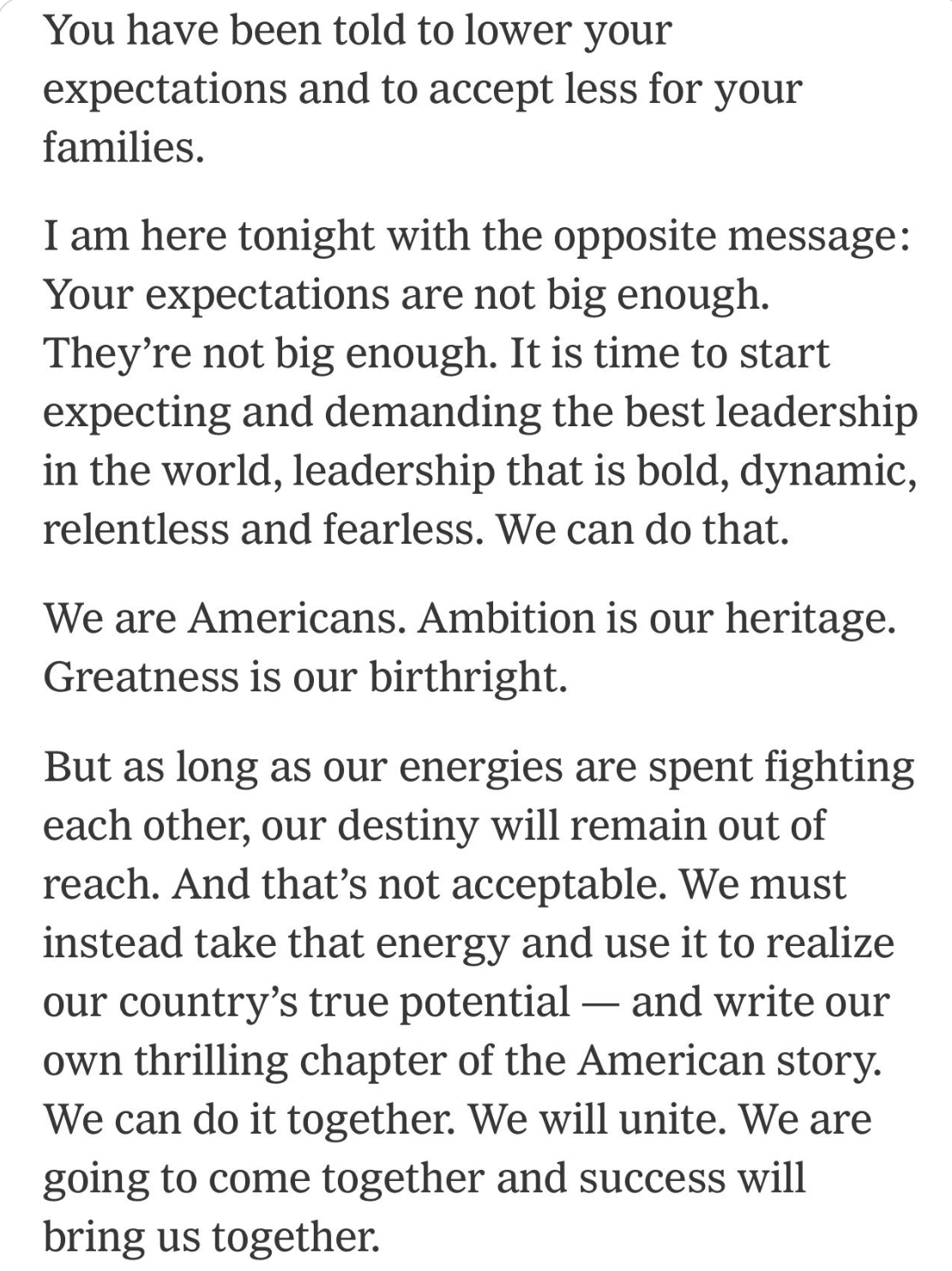

I believe that Trumps speech at Davos yesterday was the best (and most important) speech of any President on foreign soil in our lifetimes. We may disagree on how he’s accomplishing these things, but the fact its, he’s doing it. Just over a year ago we forecast that “The Trump Doctrine” would powerfully position the US vs the world by getting the government out of our lives and empowering the people, instead. Trump continues to put globalists (communists) on trial and he’s doing it directly in their face. They have a choice; change or die. The US economy, along with our storied culture and way of life, is on hyperdrive.

The screenshot below is from the end of Trump’s acceptance speech and many missed it, but it came through loud and clear in Trumps speech at Davos. This is not to be missed. When I heard Trump say “your expectations are not big enough” I immediately sat up in my chair. Trump’s thinking here shows exactly why he’s the unbridled success he is. It’s all “mindset and an understanding of the American birthright” with Trump. Here, Trump’s giving us permission to proudly seize our American birthright, just as he has. “Your expectations are not big enough. We are Americans. Ambition is our heritage. Greatness is our birthright.” Absolute genius, next level American mindset. Greatness is our birthright.

Note: I’m scheduled to be on Fox Business “Making Money” with Charles Payne in the 2PM EST hour. Hope you can join!

Until next time, thanks again for reading.

Kip

Join us for two free weeks at VRAletter.com

Please join us each day after the market closes for our Daily VRA Investing Podcast! @ https://vraletter.com/podcasts/

Also, Find us on Twitter and Rumble