VRA Investment Letter: FOMC Meeting and J Powells “I’ve got nothin’ for ya on that” Disgrace. VRA Market Update. Gold and Silver Surge Continues.

/Good Thursday afternoon. I was going to do a deep dive on yesterday’s Fed meeting and presser with J Powell, but frankly, it’s not worth our time and energy. Certainly not after Powells refusal to answer important questions that everyone has a right to know the answer to. Over the decades it’s been said that the Fed Chair is the second most powerful man on the planet, behind only the President. I think that’s right. In our modern world of financial engineering and centrally controlled economies, central banks are the masters of our financial universe and Powell is the current high priest.

With recent insider trading scandals that rocked the Fed, the fact that the Fed is losing $100 billion/year on their QE program, the DOJ investigation into a very questionable $3 billion renovation program (with DOJ grand jury subpoenas that have gone unanswered), reporters attempted (meekly) to get some answers...but Powell refused to answer anything he deemed beneath him. Instead, each time he gave reporters this reply; “I’ve got nothin’ for ya on that”, as if swatting away a bothersome fly. IMO Powell is a disgrace to the office and his lack of transparency is even further damaging the Federal Reserve.

VRA Bottom Line: the Fed left rates unchanged at 3.5 - 3.75%, with two dissenting votes (Waller and Miran). May will come soon enough, but Powell and the Fed still have answers to provide. I suspect Trump and Bessent may well get those.

VRA Market Update:

As we wrap up January, the VRA System remains at 10/12 screens bullish. We’ll be looking to initiate new ETF positions in the not-too-distant future and will give everyone a heads up as those trades approach. (For all of our VRA Alerts join us at VRAletter.com).

For our newer readers, in September 2022 Tyler and I published our book “The Big Bribe” where we forecast a generational bull market and economic boom-time into at least 2030 that would take the Dow to 100k and Nasdaq to 40k. For >3 years we’ve been the most bullish strategists in America.

Importantly, this is a “structural” bull market that’s being driven by an ocean of liquidity, corporate & personal balance sheets in their best shape in decades, an Innovation Revolution that will transform the planet and take US GDP >8% by 2028 (likely >10% average GDP into the 2030’s) and of course, The Trump Economic Miracle (tax cuts, deregulation, tariffs). We have the right president at the right time. This remains a melt-up bull market (with short-term, counter trend, overbought pauses taking place).

We keep our positions in the VRA Portfolio at no more than 15 holdings at one time and after taking profits in our ETF’s last week we now have 12 Buy Rec’s (which you’ll receive full access to with our 14-day free trial).

Gold and Silvers Surge Continues

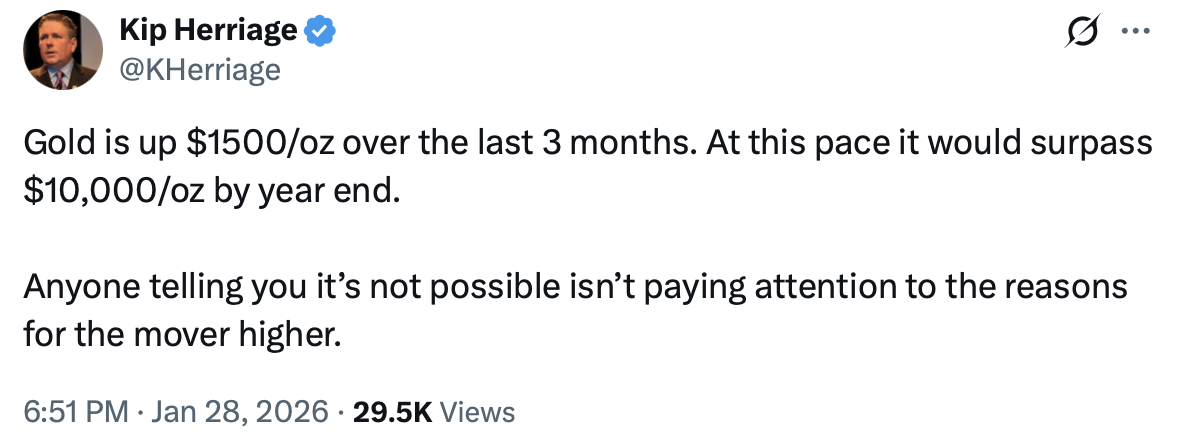

With gold hitting $5645 overnight and silver topping $120, this extreme overbought blast higher is becoming a bit surreal, especially for us long time gold/silver bugs. Demand for both appears insatiable. As we’ve covered often, this looks very much to be their Bitcoin melt-up moment. It has years to run. The miners have lagged a bit this week, as we see below in this chart of GDX to Gold. It’s a perfectly normal event, as the supporting trend line makes clear.

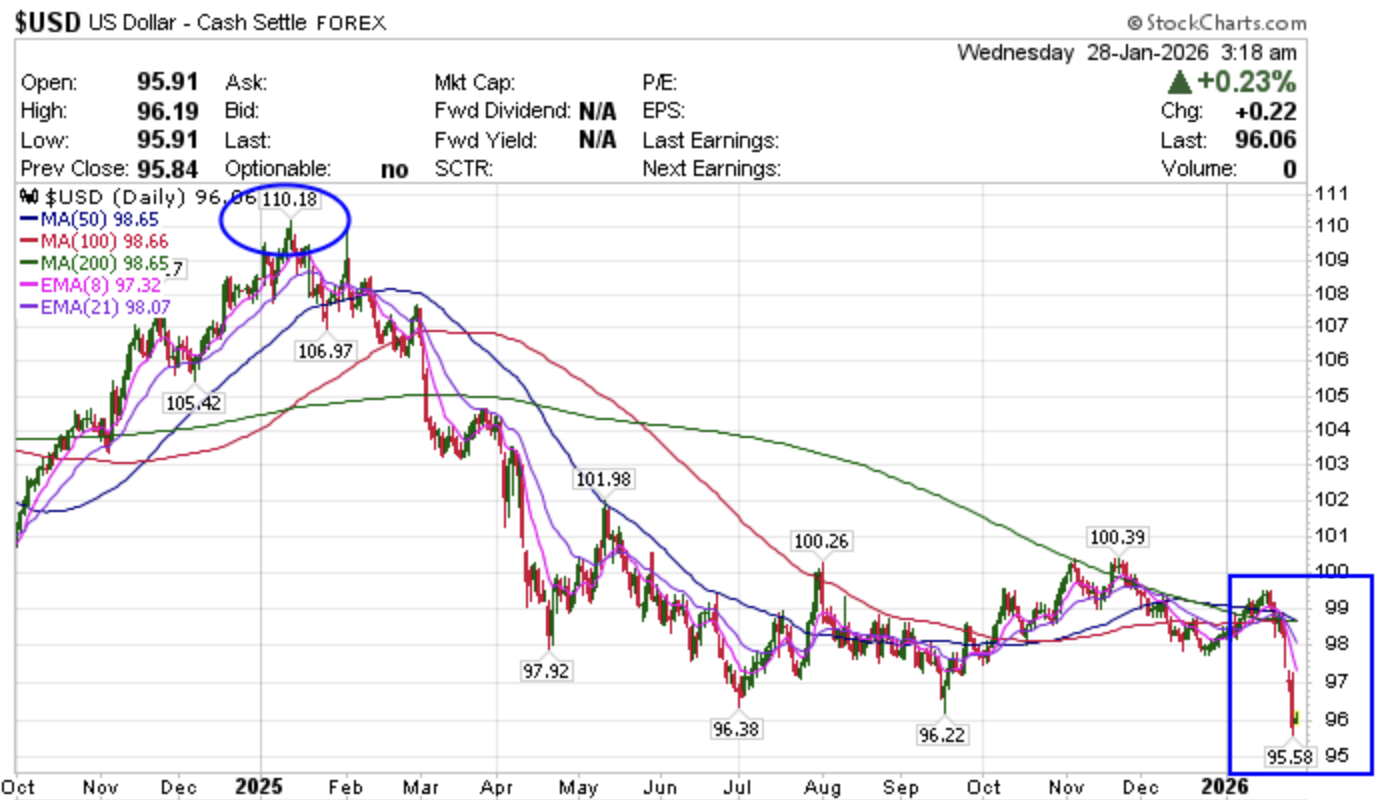

We also got these comments from Trump on Tuesday about the dollar, “the dollar is doing great (meaning it’s downside action)…I’m not concerned about the dollar weakening…that’s what other countries have done to us forever”. Immediately afterwards (I was watching Trump at the time), gold and silver got legs, as they continue to march higher.

As Trump spoke, the dollar got pounded. As we forecasted from just after Trump’s re-election, the current action in the USD is exactly what Team Trump wants to see take place. It’s also over the top bullish for gold/silver/copper/miners as well as bullish for the US economy and broad markets.

If you look up “waterfall decline” in an investing dictionary, the blue box below for this chart of the dollar is what you might see. Accelerating declines like the one we’re witnessing in the dollar are not to be messed with…we continue to see the dollar going even lower for the rest of 2026. However, the dollar is also hitting our most oversold readings of EOSOS….its likely due for a dead-cat bounce higher.

Trading note: with gold/silver and miners hitting EOBOS while at the same time the USD is hitting EOSOS, at some point we should see a countertrend move in the other direction. Again, this is basic VRA System methodology/probabilities. At the same time…and this may be the most important takeaway…the single biggest buy signal for an investment is when they hit “extreme overbought” but just keep moving higher. There is literally no technical signal that’s more bullish.

VRA Bottom Line: most believe it’s not possible for gold, silver & miners to go on their own multi-year bitcoin-like melt-up move higher (as happened with bitcoin from 2017-2024). However, with the global investing public having just 1% of their portfolio in gold/silver and even less than that in the miners, that’s exactly why it’s likely happening. A long term gold bugs contrarian delight. The fact that gold and silver barely paused at these big round numbers of $5000/oz and $100/oz is turning a lot of institutional heads.

Tyler on The Schwab Network

https://schwabnetwork.com/video/herriage-tech-rally-in-early-innings-tsla-transformative-in-ai-robotics

Until next time, thanks again for reading.

Kip

Join us for two free weeks at VRAletter.com

Please join us each day after the market closes for our Daily VRA Investing Podcast! @ https://vraletter.com/podcasts/

Also, Find us on Twitter and Rumble