VRA Investing System Update for a Generational Bull Market. Market Data That Matters. Bitcoin: The Lows Are In. Gold, Silver, Miners.

/Good Thursday morning.

Brief recap of where things stand with the VRA Investing System. Based on the lessons learned from my mentors (Ted Parson, Underwood Neuhaus and Michael Metz, Oppenheimer) I’ve spent the last 40 years building the VRA System. The VRA Investing System is made up of 12 screens, 70% fundamental and 30% technical.

Today, 10/12 VRA screens are bullish, which means we MUST be invested in this bull market. For >3 years we’ve been the most bullish market strategists in America. From calling the bear market bottom (on 10/13/22), over the last 3 years we’ve put up an average return of 37.7% vs the S&P 500, which has averaged a return of 20.7%, with an average return of just 12.7% for our primary index bogey, the Russell 2000 (small caps).

This is a generational bull market, driven by our “Big 3”; 1) the Trump Economic Miracle, 2) the Innovation Revolution and 3) an absolute ocean of liquidity. It’s this powerful combination that will continue to drive this bull market into the 2030’s…the most powerful bull market in decades…likely ever.

During the dot-com boom, a powerful bull market that saw Nasdaq jump by 570%, I helped take 3 co’s public, raising several hundred million dollars in the process while also managing more than $100 million. As powerful as that bull market was, this bull market will be longer lasting and much broader and deeper, as essentially every sector will experience dramatic earnings growth with GDP growth that will surpass 8% (by 2028) and lasting for several years. Buying dips will continue to be a gift.

Our investing strategy involves market timing (VRA System), finding the best sectors to invest in, and finally, building positions in our top growth stocks and VRA 10-baggers, companies that have the very real potential to produce gains of 1000%. We never recommend more than 15 positions at a time and yes, we do recommend taking a position in each buy rec. Today we have 12 buy-ranked holdings in the VRA Portfolio (click here to learn more).

It’s this exact approach that has helped us to outperform the markets in 19/22 years, from our founding in 2003. In addition, with our ETF Strategy we’ve booked gains of more than 4000% in ETF’s alone over the last 8 years. You can find every trade (and gain/loss) in your VRA Members Site, where we list all trades over the last decade +. We’re aware of no other financial publisher that posts every trade going back a decade.

VRA Bottom Line; this remains a generational bull market market that’s being led by a US economy with GDP growth that will soon surpass 5% (in Q1), rock solid corporate earnings, extraordinary rotational strength and a global reflation trade that continues to point to a global bull market of size and scope with years to run. We’ll continue to rely on the VRA System to ensure we are positioned correctly.

Market Data That Matters

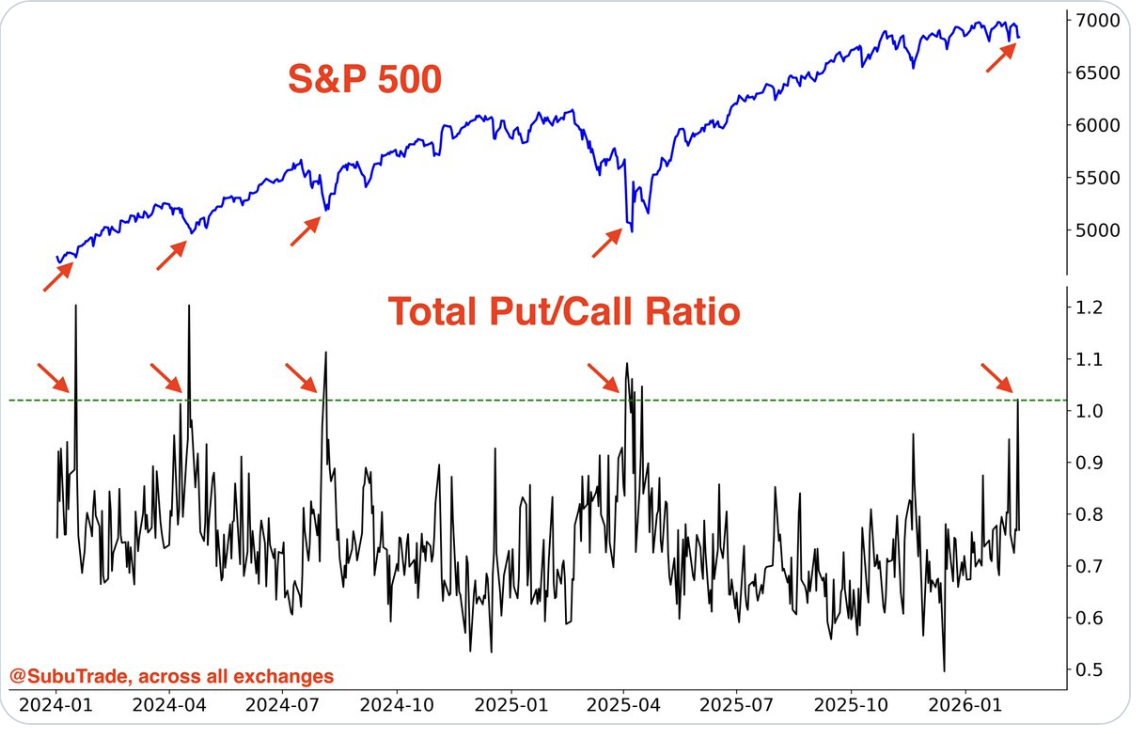

The total Put/Call Ratio just jumped to the highest reading since the tariff mania crash. This has proven to be a contrarian buy signal.

Short interest in the technology sector (XLK), is now at its highest in more than 6 years.

A contrarian buy signal.

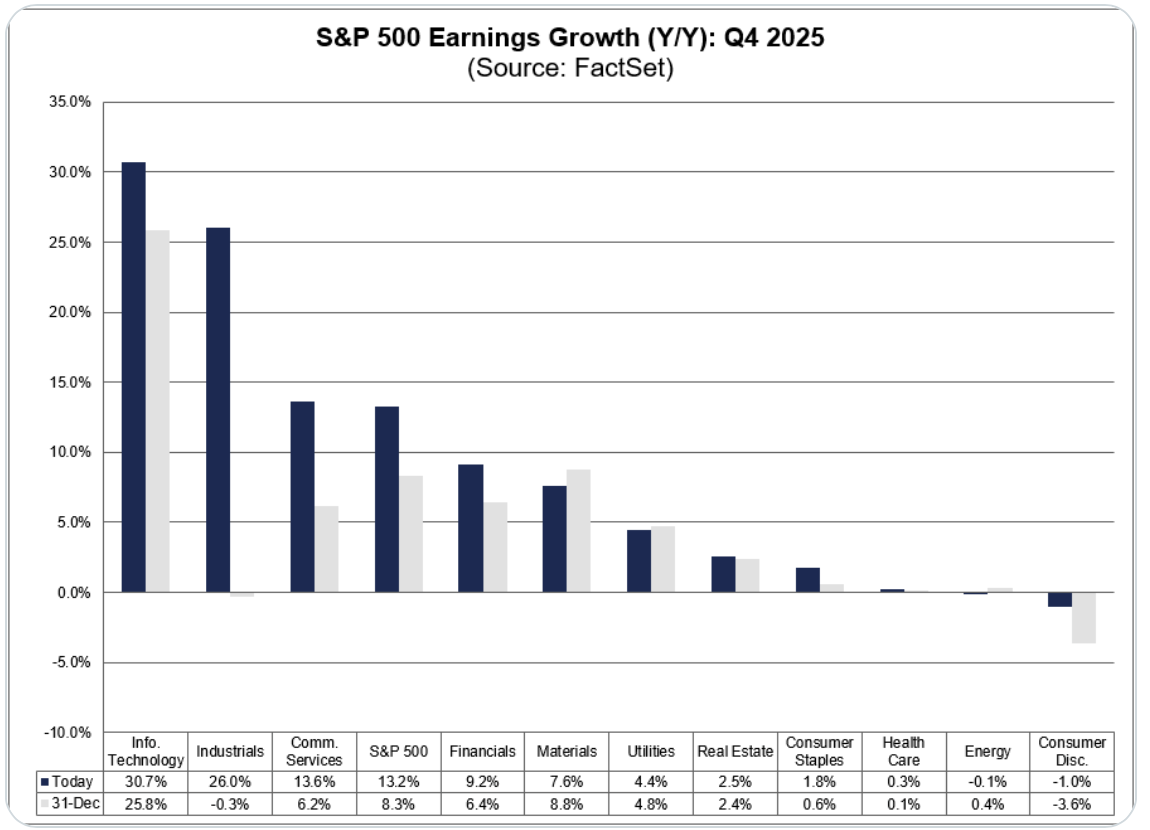

9 of 11 S&P 500 sectors are reporting Y/Y earnings growth for Q4, led by the Information Technology and Industrials sectors with EPS growth of 30.7% and 26%. At the same time, on both revenue and earnings, we’re seeing beats to analyst estimates of more than 73%.

In our favorite relative strength chart for market direction, below we see that the semis continue to lead the market higher, just as they’ve done from exactly the 4/7/25 market lows.

Bitcoin: The Lows Are In

In one of the most powerful cases of market analytics you’ll see for Bitcoin, historically, buying bitcoin after a 50% correction (like now) has a 90% win rate over the next year with a 1-year average return of +125%.

Our call: the lows are in for Bitcoin. Below we see that $IBIT (Blackrock Bitcoin ETF) had a clear selling climax 7 days ago with a record level of volume just as BTC hit its 3rd most oversold levels in history (on RSI) and as the Fear & Greed index for BTC hit its most oversold levels in history (with a reading of just “5"). In addition, IBIT hit "extreme oversold on steroids", our most oversold levels on the VRA System. The rubber band stretched too far. Capitulation. Bottom line; the lows are in. We're buyers.

Finally, an update on gold, silver and the miners. In my second-ever Letter in 2003 I recommended gold at $350/oz and silver at $5.00/oz, giving us current gains of 1300% in gold and 1400% in silver. Over these last 23 years we’ve also booked gains of more than 3500% in various mining stocks. If you had followed our advice to invest in gold rather than a fiat currency based savings account, a $100,000 investment in gold would be worth more than $1.4 million today while that same $100,000 in a savings account (in fiat) would be worth less than the $100,000 you originally invested (both after inflation).

Today, we continue to recommend owning physical gold and silver along with our 10-bagger junior gold miners, where we have current gains of 254% and 743% (Check them out now with our 14-day free trial). This bull market will take gold past $15,000/oz and silver past $300. We’ll make absolute fortunes in this group.

The big drivers? A stronger US dollar, super thin trading volumes (since Asian markets were closed for Lunar New Year), plus investors easing off safe-haven bets with no fresh geopolitical drama. It was more technical noise than fundamentals. Precious metals have been ripping higher all year and as seen below, an extreme overbought pullback was due. These dips are a buying opportunity.

Until next time, thanks again for reading.

Kip

Join us for two free weeks at VRAletter.com

Please join us each day after the market closes for our Daily VRA Investing Podcast! @ https://vraletter.com/podcasts/

Also, Find us on Twitter and Rumble